Explore our Blogs and Market Updates

Stay in the know with our timely blog content covering everything from finding the right wealth manager to important IRS tax updates! Our Weekly and Monthly Market updates will keep you up to date on economic market trends.

Recent Market Updates

Weekly Market Update – April 12, 2024

Quick Takes Stocks and bonds struggled for a second straight week, which can be chalked up to accelerating inflation data,...

Monthly Market Update – March 2024

Key Points MORE THAN JUST THE MAGNIFICENT 7 March witnessed a welcome broadening of returns and earnings. 2023 market...

Weekly Market Update – April 05, 2024

Quick Takes U.S. stocks and bonds struggled as signs of stronger manufacturing and a robust jobs market have investors...

Additional Content

Peek Behind The Curtain

As we kick off 2024, it’s likely going to be another interesting year - elections, geopolitical issues, and investment...

Decoding IRS Changes: Form 1099-K

The Internal Revenue Service (IRS) has tweaked the rules for Form 1099-K, and here’s the scoop! This adjustment comes after...

Understanding Required Minimum Distributions (RMDs)

As you prepare for retirement, you may be wondering about the many financial decisions that come with this new stage of...

Trusts and Retirement Planning: Understanding Revocable vs Irrevocable Trusts

Trusts are a crucial estate planning tool that can help individuals protect and manage their assets during their lifetime...

Silicon Valley Bank Insolvency: What You Should Know

The recent news about the insolvency of Silicon Valley Bank (SVB) has sparked concerns and questions among investors and...

Maximizing Your Investment Returns: Understanding Tax-Loss Harvesting

Investing can be a great way to grow your wealth, but it can also come with tax liabilities. Fortunately, there are...

How to Make the Most Out of your Thrift Savings Plan

The Thrift Savings Plan (TSP) is an amazing opportunity for federal employees and uniformed service members to build a...

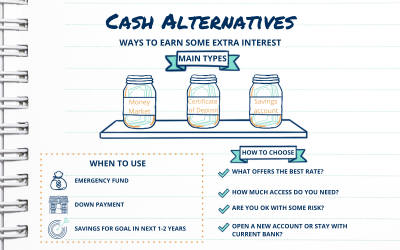

Money Market vs CD vs Savings Accounts: What Are The Best Cash Investment Options?

Are you looking to invest your cash but don't know where to start? Have you been trying to decide whether to invest in...

3 Key Areas for Investors To Focus on in 2023

I think we can all agree on one thing: investing is hard. Not necessarily in a physically painful way - like stepping on a...

Understanding the SECURE Act 2.0: How It Affects Your Retirement and Savings Plans

Click here to view our Secure Act 2.0 Interactive Timeline. Located in the 4,100 page spending bill passed by Congress on...

2023 Major Tax Changes, Tax Brackets Updates & More

This post represents 2023 taxes that will be filed in April of 2024. Preparing for 2023 means understanding all the...

Top 5 Financial Advice For High Earners – Avoid These Mistakes!

Making a considerable salary is a great achievement, but often the question at the back of most high earners’ minds is if...

Ready to get started?

Our firm has been helping families and individuals take control of their financial future for over 15 years.

Fill out the form below and one of our wealth managers will reach out to you and answer any questions you might have.

By submitting this form you consent to receive emails, phone calls, and text messaging communication(s) from The Retirement Planning Group at the email and number above. Your consent is not a condition of any purchase or obligation. Message and data rates may apply. Message frequency may vary. You are also acknowledging our Privacy Notice and Privacy Policy.