![[Blog Post] - TRPG Market Update - August 2021 | The Retirement Planning Group [Blog Post] - TRPG Market Update - August 2021 | The Retirement Planning Group](https://www.planningretirements.com/wp-content/uploads/2021/08/Market-Update.png)

Nearly a year and a half after the pandemic began, global economies continue their various recovery efforts.

As you may have experienced, this process can be unpredictable and look different even from one community to the next. The recent emergence of the Delta variant of COVID-19 is yet another curveball in this path to recovery. Despite the high degree of uncertainty that’s persisted over this timeframe, our investment portfolios and trading activity have navigated this environment well. This is not surprising given the foundation of our investment philosophy—that markets are inherently unpredictable! Global diversification is important—diversifying across countries, sectors, company size, and other characteristics allows participation in gains when and where they occur, while reducing risk compared to a more concentrated approach.

Of course, it’s not enough to just diversify. Markets change and so should portfolios. Our trading activity surged in 2020, as we kept portfolios in proper alignment. This meant quite a bit of buying stocks in March and April of last year, after they had plummeted in price. This also meant later trimming exposure as stocks outgrew their intended targets.

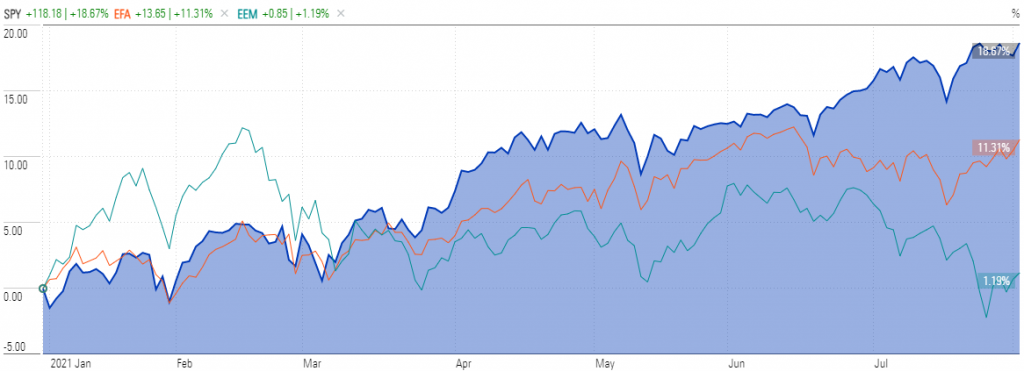

We also increased our focus on U.S.-based companies, which has continued to work well in 2021. The rationale stated then was the aggressive response from the Federal Reserve and stimulus efforts from the federal government, which have been a driving force for recent growth. A large infrastructure bill looks closer to being reality, which could further boost growth domestically. The chart below shows this U.S. stock outperformance (blue shade), relative to foreign developed markets (orange line) and emerging markets (light blue line).

Source: Morningstar. U.S. stocks represented by SPY, Foreign developed markets by EFA and emerging markets by EEM. Data as of 8/3/2021.

Where appropriate, we also continue to see success with our active bond strategies. The flexibility and expertise they incorporate have provided a meaningful and positive contribution to performance.

Looking forward, there are a wide range of outcomes that can occur from here. We’re still dealing with uncertainty from COVID recovery, and tension between the U.S. and China continues. Stocks remain expensive relative to history. Inflation continues to be a topic of concern. The Fed has stuck to their story of it being temporary in nature, but markets don’t always believe the Fed. So far, pockets of inflation have appeared, but nothing alarming or completely unexpected. Another story that may continue to gain attention is that of climate change, and the impact on the investing landscape. We continue to tilt a portion of the portfolio toward technology-based businesses that should be able to better make a green transition.

Despite the ongoing concerns and uncertainty we’re currently faced with, history suggests markets are likely to be resilient and reward investors that stay committed to the long term.

Our investment committee remains diligent about keeping your portfolio in balance with the current environment while still being positioned for long-term opportunities and aligned to your goals, objectives, and unique circumstances.

As always, we encourage you to reach out to your wealth manager with any questions or changes to your financial situation.

Stay safe and healthy!

Kevin Jaegers, CFA

TRPG Investment Committee