Market Performance Summary

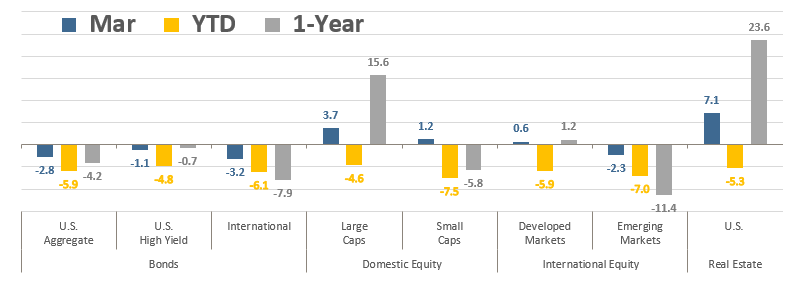

After most asset classes cruised to solid gains in 2021, the first quarter of 2022 has been much more challenging for markets. All major asset classes were negative for the first quarter of 2022, but March brought some reprieve from the madness. U.S. and developed international stocks, along with Real Estate were able to manage positive results for the final month of the quarter and mitigate some of the downside from January and February. Unfortunately for emerging market equities and global bonds, the downside slump continued.

Asset Class Total Returns

Source: Bloomberg, as of March 31, 2022. Performance figures are index total returns: U.S. Bonds (Barclays U.S. Aggregate Bond TR), U.S. High Yield (Barclays U.S. HY 2% Issuer-Capped TR), International Bonds (Barclays Global Aggregate ex USD TR), Large Caps (S&P 500 TR), Small Caps (Russell 2000 TR), Developed Markets (MSCI EAFE NR USD), Emerging Markets (MSCI EM NR USD), Real Estate (FTSE NAREIT All Equity REITS TR).

Global equities had a difficult quarter to begin 2022 as Russia’s invasion of Ukraine sparked volatility across global markets, exacerbating already rising inflation and commodity prices and threatening earnings and economic growth, which were already forecasted to slow as 2022 progressed. For U.S. large cap equities, it was the first negative quarter in the last eight, ending the longest quarterly win streak since Q4-2017. Even in decline, U.S. large cap equities outpaced all other major asset classes for the quarter. U.S. small caps fell -7.5% and have now trailed large caps for the fourth straight quarter. International equities declined for the second quarter in the last quarters, falling -5.9%, their worst quarter since Q1-2020. Emerging market equities fell -7.0% in Q1 and have now underperformed developed market equities for five consecutive quarters. Real estate, which was the top performing asset class in March (up +7.1%) was still down -5.3% for the quarter as higher interest rates threaten to cool a hot market.

Speaking of higher rates, the U.S. fixed income market fell for the first time in four quarters as the Bloomberg U.S. Aggregate Bond Index declined -5.9%, its worst quarter since Q3-1980. In March the Federal Reserve kicked off the first interest rate hiking cycle since 2018 and markets are anticipating further tightening throughout the year. High-yield bonds declined for the first time in the last eight quarters, losing -4.8%. As tough as it was for U.S. bonds, it was worse for international bonds, which dropped -6.1% in Q1, marking the fifth consecutive quarter of underperformance versus U.S. bonds.

Source: Bloomberg.

Quick Takes

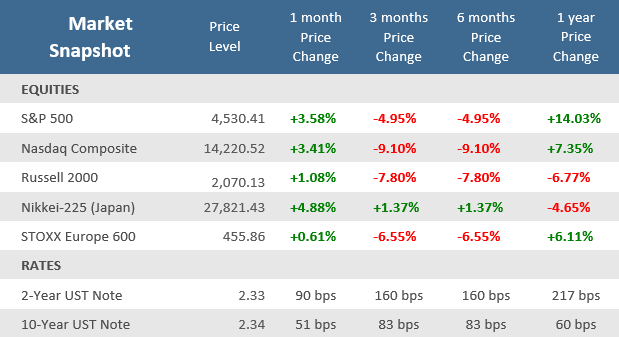

One Quarter A Trend Does Not Make.

The S&P 500 was down -4.6% in Q1-2022, its first negative quarter since Q1-2020. But a negative quarter is not unusual. Since 1992, the U.S. stock market has seen 67% of calendar years experience a negative quarter, yet 83% of full calendar years have been positive.

In many years the stock market has a negative quarter, but the full year is still positive.

Source: Bloomberg, Standard & Poor’s, The Retirement Planning Group.

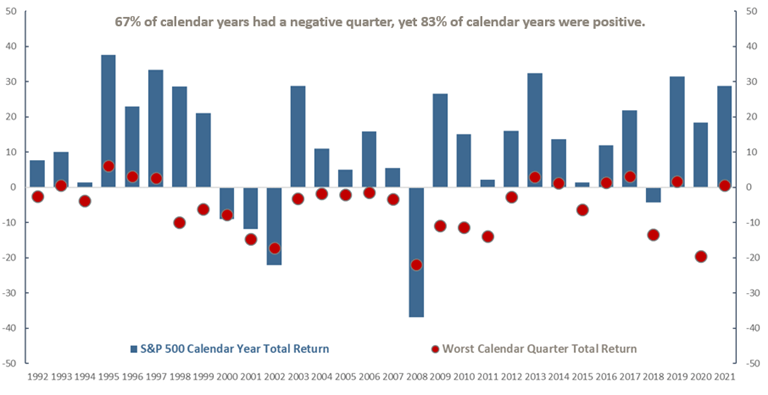

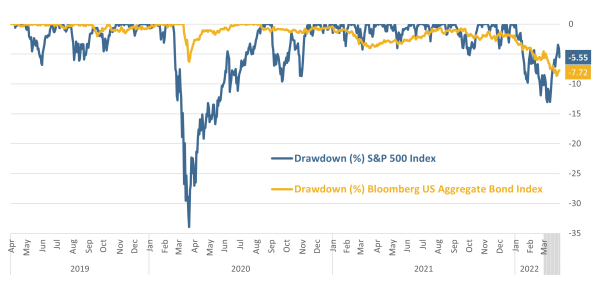

Double Dip.

After much anticipation, the Federal Reserve raised interest rates by 0.25% percentage points in March for the first time since 2018, beginning the process of interest rate normalization. When the Fed raised interest rates, it also indicated that it may accelerate the pace of interest rate hikes for 2022 beyond what they had previously forecasted. This helped push yields to invert, discussed further below, and has resulted in the longest drawdown in history of the Bloomberg Aggregate Bond Index (410 days through March 31 and counting) and the largest since 1981 (it was -8.7% at its worst on 3/25/2022, before recovering to -7.7% at the end of March). Of course, stocks are also down from their all-time high set on the first trading day of 2022 (1/3/2022). Stocks entered a so-called “correction”, considered a loss of -10% or worse, for the first time since the Spring of 2020 on the way to its pandemic low. The current S&P drawdown maxed out on 3/8/2022 at -13.0%, but after the late March rally, it cut that to -5.6% at the end of the month.

% Drawdowns From All-Time Highs

Source: Bloomberg.

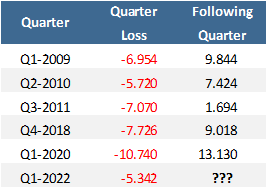

With both primary U.S. broad asset classes in negative territory, a 60/40 portfolio (60% S&P 500 and 40% Bloomberg Aggregate Bond Index) was down -5.3% in Q1-2022. That’s frustrating for investors, but LPL strategist Ryan Detrick points out that the past 5 times it was down -5% or worse, the subsequent quarter was nicely positive.

60% S&P 500 / 40% Bloomberg Aggregate Bond

Last 5 quarterly losses of -5% or worse

Source: Bloomberg.

Roller Coaster.

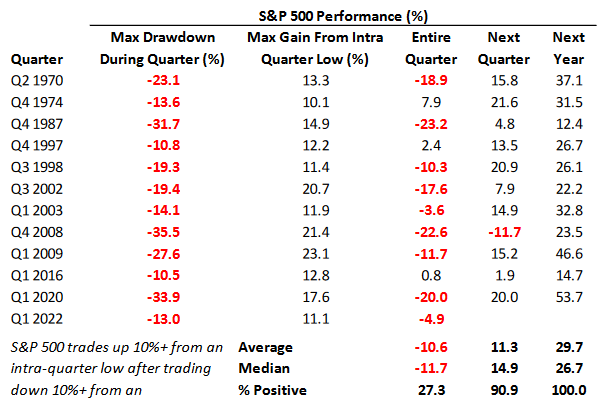

As mentioned above, the S&P 500 experienced its first correction in Q1-2022 since Q1-2020, as it fell -13.0% from its all-time high on 01/03/2022 through 03/08/2022. But from that Q1 low, the S&P 500 then went on to rally +11.0% through 3/29/2022. That was a relatively rare double-digit loss and double-digit gain in the same quarter. Bespoke Investment Group reports that since WWII, there have only been eleven other quarter where the S&P 500 has seen a 10% or greater drawdown, and then a 10% of greater gain from its intra-quarter low. Looking ahead at performance in the quarter and year that followed from those eleven incidents, the S&P 500’s performance was consistently higher both over the following quarter and the following year.

S&P 500 10% Down and Up Quarters: 1945 – 2022

Source: Bespoke Investment Group.

♫ One of These Things Is Not Like the Other ♫

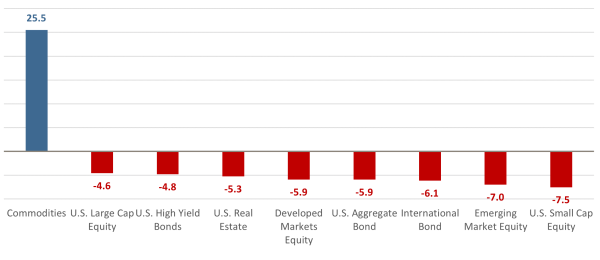

In the standard “Asset Class Total Returns” table that begins our Monthly Market Updates, commodities are not shown. In terms of “major” asset classes, commodities are certainly a valid one, but in pragmatic terms they are relatively minor among the other primary asset classes — both in investor portfolios but also as a percentage of aggregate global market capitalization. Although difficult to estimate, the study “Historical Returns of the Market Portfolio” puts the weight of commodities at 1.5% of the global market portfolio in 2017 (the most recent publication of the data set). Notwithstanding its relatively diminutive weight among global assets, it has been garnering a much larger share of headlines recently. Look no further than the performance of the first quarter of 2022 for that attention. Including commodities in the Q1-2022 performance table shows commodities not only leading the other asset classes, but the only positive asset class. But what truly stands out is its +25.5% Q1 return, which is 30.1% higher than then next best asset class, U.S. equities with a -4.6% Q1 return! Commodities are one of the most volatile asset classes, particularly during times of geopolitical turmoil. The Q1-2022 performance is the Bloomberg Commodity Index’s best quarterly return since it gained +27.4% in Q3-1990, in the aftermath of Iraq’s invasion of Kuwait. The index has now advanced in seven of the last eight quarters since it dropped -23.5% at the inception of the pandemic in Q1-2020. The Russian-Ukraine war has put commodities in the crosshairs of the conflict, resulting in skyrocketing prices for many key commodities — most of which were already seeing steep increases as global inflation mushroomed in the wake of economies reopening from COVID lockdown and restrictions over the last two years.

Q1-2022 Total Returns

Source: Bloomberg, as of March 31, 2022. Performance figures are index total returns: U.S. Bonds (Barclays U.S. Aggregate Bond TR), U.S. High Yield (Barclays U.S. HY 2% Issuer-Capped TR), International Bonds (Barclays Global Aggregate ex USD TR), Large Caps (S&P 500 TR), Small Caps (Russell 2000 TR), Developed Markets (MSCI EAFE NR USD), Emerging Markets (MSCI EM NR USD), Real Estate (FTSE NAREIT All Equity REITS TR), Commodities (Bloomberg Commodity Index).

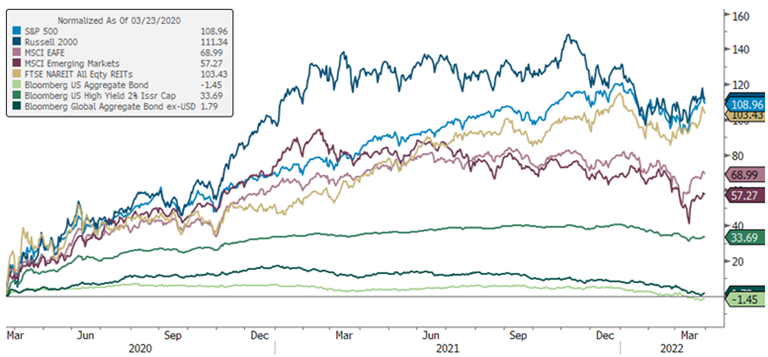

Anniversary of COVID Bottom.

COVID-19 was officially declared a pandemic by the World Health Organization just over two years ago on March 11th, 2020. In the early days of the pandemic investors aggressively sold equity positions, resulting in a market crash that saw the S&P 500 plunge -33.9 in just 23 days as the VIX volatility index soared to over 85. In response to the unprecedented near total shutdown of the economy, the Federal Reserve and the Federal Government pumped unprecedented amounts of monetary accommodation (lowering interest rates to near zero, expanding the balance sheet, etc.) and fiscal stimulus (relief packages, payroll protection, easing tax burdens, etc.) into the economy. Opinions on the appropriateness of the COVID response from the government and Fed run the gamut, but it is hard to argue that it didn’t curtail what would likely otherwise have been a prolonged recession, or depression. Indeed, financial markets saw a meaningful boost, and had the quickest bear market recovery on record as the S&P 500 recovered its losses in just 103 days after bottoming on 3/23/2020. Now, just over two years from that bottom, the S&P 500 is up +109% (total return with dividends reinvested), well above its pre-COVID high.

Major Asset Class Performance Since the Pandemic Low

Total Returns, 03/23/2020 -03/31/2022

Source: Bloomberg, Bespoke Investment Group.

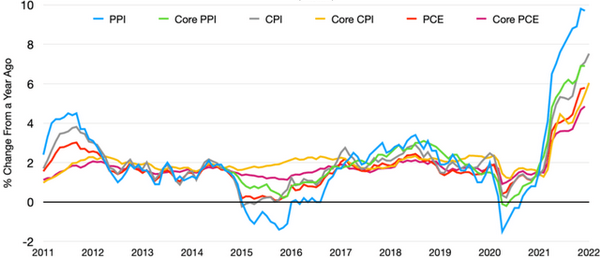

Inflation is Still Rising.

At the beginning of 2022, inflation had reached a 40-year high of 7.5%. It has only continued to get worse since. Virtually all conventional measures of inflation have spiked in unison in 2022, from consumer to producer, from headline measure to core measures (which exclude the more volatile food and energy components). And although the chart below is only showing U.S. inflation gauges, Europe is also facing the highest inflation in more than 40 years as higher energy prices and natural gas rationing take hold. Indeed, the global economy is facing a perfect inflation storm of lingering supply chain challenges, the aftermath of nearly two years of massive stimulus payments, and now a war in Ukraine with its broad-based, and growing, sanctions.

Any way you slice it, inflation has surged

Source: Bloomberg.

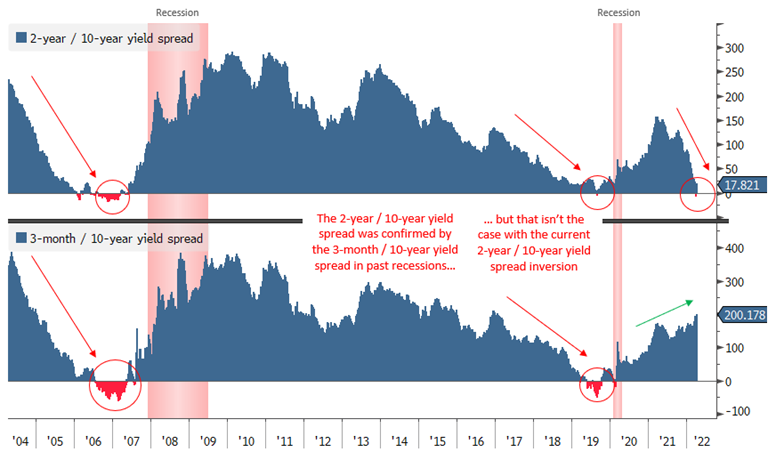

Yellow Light, Not Red Light.

On the final day of March, the yield on the 2-year U.S. Treasury closed higher than the yield on the 10-year Treasury for the first time since August 2019. Financial pundits had been watching in anticipation because in the past such inversion have been a warning sign for a recession. The 2019 inversion was short-lived lasting just seven days at the end of August amid the trade war with China but was indeed followed by the COVID-induced recession of 2020. The last persistent inversion of the 2-year/10-year Treasury curve occurred in 2006-2007. Yield curves typically slope upward, so when short-term yields are higher than longer-dated ones, it suggests there is reason to worry about future economic growth. Other portions of the yield curve had already inverted, last October the 20-year yield topped 30-year yields, and on March 28 the gap between 5-year and 30-year yields turned negative. But it is the 10-year and the 2-year curve that is most closely watched by financial media. However, another part of the yield curve, the 10-year and three-month yields, remains positive and rising and therefore is not confirming the warning from the 10-year and 2-year curve. The 10-year/3-month yield curve is closely monitored by the Fed and has the longest track record, and success, of anticipating recessions—it has inverted prior to the last eight recessions going back to 1970. And now it is positive and rising. Many believe that the yield curve signal may not be as good of an indicator as it has been in the past, because of all the unprecedented quantitative easing undertaken by central banks around the world. Federal Reserve Chairman Jerome Powell also recently stated that he’s paying more attention to the first 18 months of the yield curve rather than anything that goes on afterwards.

Yield Curve Inversion Perversion

3-month/10-year curve not confirming 2-year/10-year inversion

Source: Bloomberg.

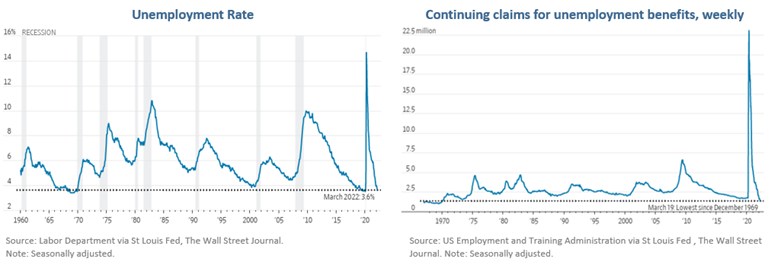

Tight as a Drum.

In addition to the 3-month / 10-year yield curve not indicating a recession, the U.S. labor market is far from signaling recession. The U.S. Unemployment Rate has fallen to 3.6%, the lowest level since the start of the pandemic and only 0.1% above the 50-year low in February 2020 (3.5%). New applications for U.S. unemployment benefits are near the lowest they’ve been since 1969. Other than the lockdown-induced pandemic recession, the U.S. has never seen a recession until the 4-week moving average of unemployment claims have spiked more than +20% — it is still declining. And it isn’t likely to go higher anytime soon, there are currently 5 million more job openings than unemployed people in America, an all-time high.

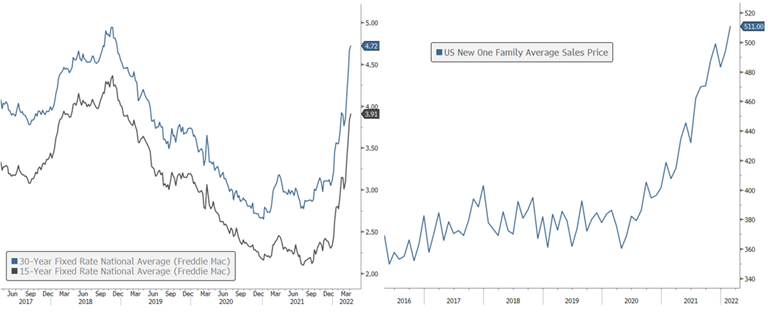

Housing Affordability Anguish.

Mortgage rates are back to levels last seen in early 2019, while prices for homes have surged due to low inventory and heavy demand. Rates on 30-Year Mortgages are up over 1.5 percentage points just this year and are now over 4.7%. The average price of a new home sold in the US has hit a record $511,000, up 25% over the last year alone. Higher prices and the sharp rise in mortgage rates has put pressure on home sales as homebuyer affordability falls. After a strong surge in home sales in 2021, sales have dipped and are now down just over 10% to begin 2022. Inventory is expected to remain low, and rates should continue to push higher in the near term.

Mortgage Rates and Home Prices Rise

Source: U.S. Census Bureau, Bloomberg.

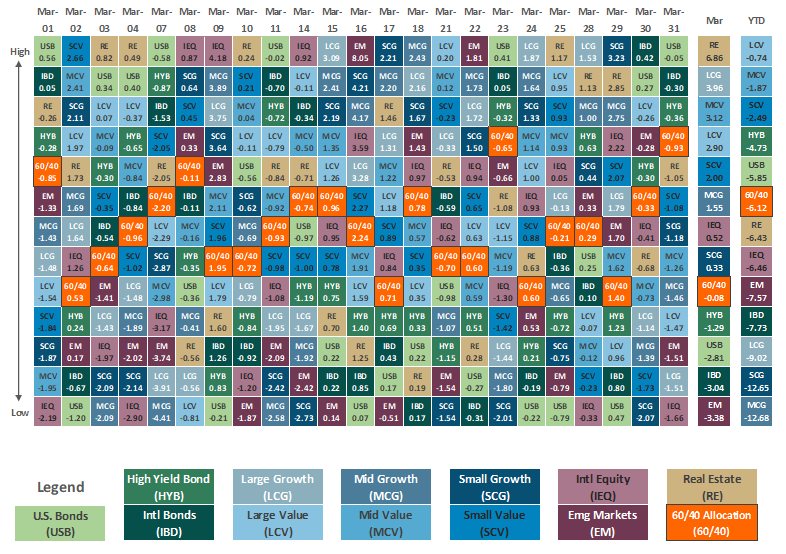

Asset Class Performance

The Importance of Diversification. Diversification mitigates the risk of relying on any single investment and offers a host of long-term benefits, such as lowering portfolio volatility, improving risk-adjusted returns, and helping investments to compound more effectively.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by The Retirement Planning Group. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Chris Bouffard is CIO of The Retirement Planning Group (TRPG), a Registered Investment Adviser. He has oversight of investments for the advisory services offered through TRPG.

Disclaimer: Information provided is for educational purposes only and does not constitute investment, legal or tax advice. All examples are hypothetical and for illustrative purposes only. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed. Please contact TRPG for more complete information based on your personal circumstances and to obtain personal individual investment advice.