Quick Takes

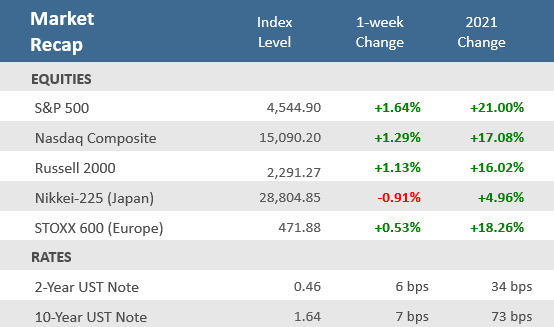

- The October rebound continues and following seven straight days of gains, the S&P 500 hit its 55th record close of 2021 on Thursday. Although the index slid back a bit on Friday, it still advanced for the third consecutive week. The Nasdaq Composite and Russell 2000 Index of small-cap stocks were also up +1.3% and +1.1% respectively.

- After declining last week, the yield on the US 10-year Treasury went back on the rise, moving up +7 basis points from the prior Friday to finish the week at 1.64%. As a result, the Bloomberg Barclays US Aggregate Bond Index dropped -0.5% for the week, bottom among major asset classes.

- Economic reports were a mixed bag with jobless claims making another post-pandemic low but the Leading Economic Index missing estimates. Manufacturing PMI activity disappointed while service PMI activity beat expectations. Homebuilder sentiment unexpectedly improved, but housing starts and building permits disappointed.

October’s rebound continues as stocks return to all-time highs

Third-quarter earnings season shifted into high gear over the week, with most companies posting solid quarterly results, helping to propel stock indices to record highs late in the week. According to FactSet, more S&P 500 companies are beating EPS estimates for the third quarter than average and beating EPS estimates by a wider margin than average. So far, with almost a quarter of S&P 500 companies having reported, about 84% are beating earnings estimates which are above the five-year average of 76%. The good earnings news helped propel stocks to all-time highs, with the S&P 500 hitting record highs on Thursday and the Dow Jones Industrial Averages closing the week at all-time highs on Friday. The good earnings results and market sentiment sent volatility down, with the CBOE Volatility Index (VIX) closing at 15.01, its lowest level since February 2020. US bonds were the only negative asset classes for the week, hampered by a resumption in the rise of Treasury rates after a brief reprieve last week. The yield on the benchmark 10-year US Treasury note increased to 1.64% from 1.57% the previous week. The real story for bonds though, was the flattening of the yield curve, in which rates for the short end of the curve jumped more than rates for 10-year and 30-year notes did amid expectations for the Fed to hike rates sooner than expected as inflation pressures persist.

Economic results were mixed but most indicators are still at healthy levels. Existing home sales soared and homebuilder sentiment unexpectedly improved, but housing starts and building permits disappointed. The preliminary Markit Purchasing Manager Indices (PMIs) saw manufacturing activity miss forecasts while services activity beat expectations. Overseas, economic data was more challenged. China’s third quarter GDP missed expectations, coming in a 4.9% – down from 7.9% in the prior three quarters. China is also suffering from a housing slump. Growth in eurozone business activity also slowed as IHS Markit’s Flash Composite Purchasing Managers’ Index fell to a six-month low of 54.3 in October from 56.2 in September. The International Monetary Fund cut this year’s economic growth forecast for Asia, warning that supply chain disruptions and inflation pressures pose downside risks to the outlook.

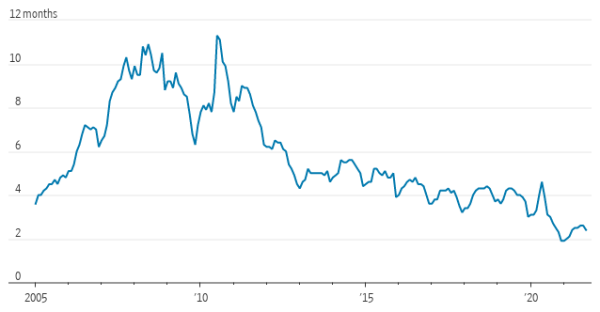

Chart of the Week

Existing Home Sales surged in September, ending a long stretch in which housing market activity slowed from the hot pace earlier in the year. A late-summer dip in mortgage rates helped spur an uptick in demand. Sales were especially robust at the high end, aided by a rebound in the stock market. The National Association of Realtors said overall existing-home sales rose +7% in September to a seasonally adjusted annual rate of 6.29 million, beating expectations for 6.10 and up from 5.88 million in August. Near-record high prices have made it harder for first-time buyers, as they fell to 28%, the lowest level since July 2015. Many homes are selling above listing price and the supply of homes available for sale remains historically low.

Home supply remains historically low

Supply of existing homes for sale at present sales pace

Source: FactSet, The Wall Street Journal.

Economic Review

- September Industrial Production (IP), which includes output at factory, mining, and utility companies, fell at its sharpest rate since February, at a seasonally adjusted -1.3% from August. August IP was revised down to a drop of -0.1% from a +0.4% rise previously. Despite last month’s drop, IP rose at an annual rate of +4.3% in the third quarter, marking the fifth consecutive quarter with a gain of more than 4%. On a year-over-year basis, IP was up +4.6%. Supply-chain disruptions in the auto industry and the lingering effects of Hurricane Ida weighed on manufacturing and mining. Capacity Utilization, which reflects how much industries are producing compared with what they could potentially produce, fell -1.3% in September to 75.2%, missing expectations for a 76.5% reading…

- Home-builder confidence unexpectedly rose in October with the National Association of Home Builders (NAHB) Housing Market Index up for the second straight month to 80 from September’s 76 level and forecasts for 75.

- Residential construction activity disappointed with Housing Starts badly missing expectations in September, down -1.6% from August to an annual pace of 1,555,000 units, well below the forecast of 1,615,000 units, and behind August’s downwardly revised 1,580,000 units. Building Permits, one of the leading indicators tracked by the Conference Board, fell -7.7% to an annual rate of 1,589,000, also below expectations of 1,680,000, and under the downwardly revised 1,721,000 in August. One positive was that all the weakness was in multi-family units not single-family units, which were essentially flat.

- The Fed Beige Book noted that economic growth continued at a moderate to modest pace, but several Districts did see a slower pace of growth for the period. The majority of Fed Districts indicated positive growth in consumer spending. Employment continued to improve but was tempered by a low supply of workers. Regarding inflation, most Districts reported significantly elevated prices, with supply-chain issues contributing to rising input costs.

- Initial Jobless Claims made another post-pandemic low, falling to 290,000, beating expectations of 297,000 and compared to an upwardly revised 296,000 the prior week. Continuing Claims fell to 2.481 million, better than the 2.548 million forecast and the revised 2.727 million the prior week.

- The October Philly Fed Manufacturing Business Outlook Index fell to 23.8, remaining in expansion territory (above zero), but below forecasts for a drop to 25.0 and down from 30.7 in September.

- The Conference Board’s Leading Economic Index (LEI) rose +0.2% in September, below estimates for a +0.4% gain and down from a downwardly revised +0.8% increase in August. The LEI was positive for the seventh-straight month, driven by contributions from ISM new orders and jobless claims. Building permits and consumer expectations were detractors.

- The preliminary October Markit U.S. Manufacturing PMI Index fell to 59.2 from September’s unrevised 60.7 but remains well in expansion territory (levels above 50), and was below expectations for a dip to 60.5. The preliminary Markit U.S. Services PMI Index rose to 58.2 from 54.9 in August and above forecasts for 55.2. Markit mentioned that companies ramped up hiring in October as employment increased at the fastest pace since June.

The Week Ahead

Next week will see a flood of earnings reports with about 30% of the S&P 500 companies set to report profits. There are also some key economic reports on the calendar with Home Prices, Durable Goods Orders, and third-quarter GDP. Personal Consumption Expenditure (PCE) data is out on Friday which includes the Fed’s preferred gauge of inflation.

Did You Know?

OVER HERE, OVER THERE — In the U.S., prices for food consumed in the home increased 4.5% in September compared with the same month of 2020. In the euro area, prices for food, tobacco, and alcohol were just 2% higher (Source: Eurostat, The Wall Street Journal).

WHEN DID THEY SPEND IT? — An estimated $3.3 trillion of additional cash has been accumulated in bank accounts by American households since the beginning of the pandemic, i.e., cash that would have previously been spent (and not saved) if the pandemic had not occurred (Source: Longview Economics, BTN Research).

DEBT CEILING — On Thursday, October 14, 2021, President Biden signed a debt ceiling bill that adds $480 billion to our existing debt ceiling, bringing the limit up to $28.9 trillion. Current projections have Congress breaching that new limit on Friday, December 3, 2021 (in less than seven weeks), but the actual end date is unknown (Source: Congress, BTN Research).

This Week in History

This week in 1929, William Peter Hamilton, editor of The Wall Street Journal and one of the leading advocates of the “Dow Theory” of technical analysis, predicted the coming demise of the bull market in a lead editorial. Since he had already predicted the death of the bull market in January 1927, June 1928, and July 1928, nobody listened. This time he turned out to be right, as the stock market crashed just three days later. (source: The Wall Street Journal).

Asset Class Performance

The Importance of Diversification. Diversification mitigates the risk of relying on any single investment and offers a host of long-term benefits, such as lowering portfolio volatility, improving risk-adjusted returns, and helping investments to compound more effectively.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent the performance of specific mutual funds and/or exchange-traded funds recommended by The Retirement Planning Group. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Chris Bouffard is CIO of The Retirement Planning Group (TRPG), a Registered Investment Adviser. He has oversight of investments for the advisory services offered through TRPG.

Disclaimer: Information provided is for educational purposes only and does not constitute investment, legal or tax advice. All examples are hypothetical and for illustrative purposes only. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed. Please contact TRPG for more complete information based on your personal circumstances and to obtain personal individual investment advice.