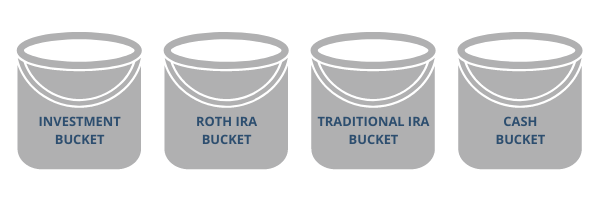

Many retirees have several different types of retirement accounts that make up their nest egg.

We call these accounts buckets. There is the Investment bucket i.e. the taxable bucket, the Roth IRA bucket, the Traditional/Rollover IRA bucket, and the cash bucket.

To create income for a retiree we need to decide which bucket to pull from, or even what combination of buckets to pull from, to best generate the retirement income desired.

The reason for this is that each type of bucket triggers a different type of tax liability. Rollover IRA distributions are taxed as ordinary income. Investment accounts have capital gains. Distributions from a Roth IRA are tax-free. Plus there are many outside factors that must be accounted for.

Pensions and Social Security

These other sources are important to note. Pension income increases your taxable income. Though some pensions are not taxed by your state. How you distribute your assets also plays a big role in how much of your Social Security is taxable. So, if you are doing it wrong, you could be paying too much in taxes.

Current tax rate versus potential future tax rate

Sometimes a retiree may initially have surprisingly low-income levels which means a low tax rate. This could present an ideal time to pull money out of the Traditional/Rollover IRA bucket at a favorable rate. This will also benefit you a little further down the road when your Required Minimum Distributions kick in at 72 years of age.

Highly appreciated assets in investment accounts

Much research applies to the rule of thumb that taxable assets are best used first and tax-deferred used last. How do highly appreciated assets factor into this and the potential for capital gains tax? Capital Gains impact your AGI which can impact taxes on Medicare premiums.

Balance of Traditional or Rollover IRA relative to overall nest egg

Required Minimum Distributions begin at 72 years of age* for all Traditional/Rollover IRA’s and 401(k)’s (if you are not still working for the company). Having a large balance in your IRA may be a good thing but could be painful tax-wise if you wait until 72 to distribute anything from that account. The overarching goal is to distribute assets as efficiently as possible. In other words, minimizing the amount of taxes you pay and keeping more of your money in your buckets.

Paying close attention to all the different tax implications of distributing your assets can make a significant impact on the size and longevity of your nest egg.

*As of 01/01/2020

Retirement Income Planning

Focusing on investments, pensions, social security, tax and estate planning.

Investment Advisory

From active portfolios to mutual funds, IRA’s 401k’s, and more.

Income Tax Preparation

Come tax season, these advisors are your best friend, navigating the tax code with ease for the best return.

Financial Planning

Your long-term partner, helping you through every stage of your finances from the moment you meet all the way through your retirement.