Regularly Monitoring

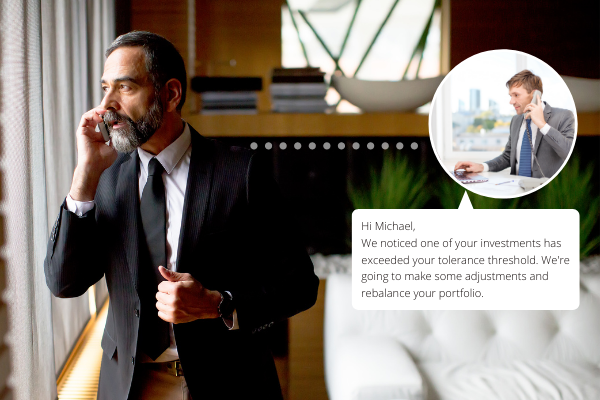

If you have hired or are considering hiring an advisor to manage your account, you would be perfectly within reason to assume your advisor is “watching” your investments. But are they really paying attention?

We hate to be the bearer of bad news, but some other firms’ advisors aren’t watching investments that closely.

Typically investors at other firms only get attention applied to their portfolios for two reasons:

You call in to inquire.

You are coming in for an appointment.

Sometimes advisors just don’t have the bandwidth, systems, processes, support, and technology to keep tabs on each clients’ account. And that lack of attention can come at a cost to you.

You Deserve More – We Provide More.

At The Retirement Planning Group, we have a dedicated on-site team that monitors the investments in our client’s accounts year-round. We can do this because we’ve made massive investments in technology and staff that allow us to keep a watchful eye on our client’s portfolios. We are able to assign a tolerance band around each of the investments for our clients.

Think of tolerance bands as guardrails on a highway – they keep the portfolio on track and, more importantly, from careening off the side of a cliff.

- If a certain investment becomes underweighted, it’s brought to our attention.

- If a position becomes overweight (due to growth in value), it’s brought to our attention.

- If the cash in a clients’ account gets too low, it’s brought to our attention.

- If a tax opportunity presents itself, it’s brought to our attention.