Rebalancing

Rebalancing is the action we take to make sure your investments stay on track – which keeps you on track!

How Does Rebalancing Work?

Rebalancing starts with focusing on the recommended stock-to-bond ratios for each account and making sure those are on target. From there we dig deeper and look at each position that makes up each account.

For instance, if you own a certain investment and we have targeted that investment to make up 10% of your portfolio, but the investment has grown so much that it now represents 15% of your portfolio, we will sell enough of the position to bring it back to the 10% weighting.

We’ve been managing money like this for over a decade!

Why We Rebalance:

By constantly analyzing each position in every account, we are able to identify opportunities all year long. Rebalancing typically occurs when one position is overweight (due to growth) and/or another position is underweight (due to decline).

When we rebalance the account, it takes the profit from the overweighted position and invests that profit into the underweighted position. Essentially following the age-old advice of sell high and buy low.

Why Don’t All Advisors Rebalance?

It takes time, it is complicated and advisors at other firms often don’t have the resources to monitor as deeply as we do.

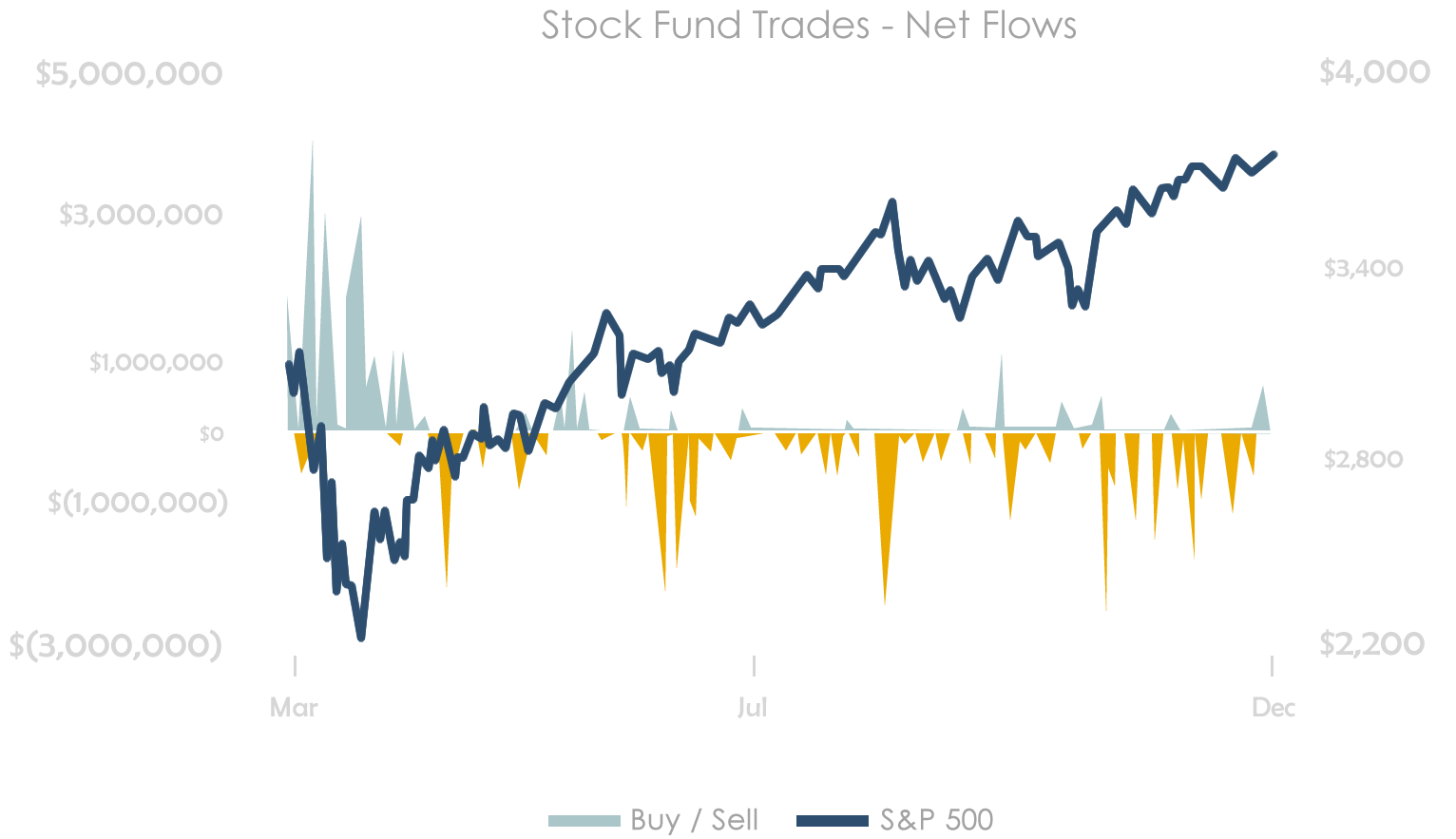

That said, some advisors implement a “quarterly” system and blindly rebalance every quarter on the quarter. But this is a mistake – as market opportunities don’t happen on January 1, April 1, July 1, and Oct 1. The Retirement Planning Group rebalances when necessary — for instance, during the Covid-19 Outbreak which happened in the middle of the first quarter of 2020. This chart represents our rebalance activity. Each vertical bar represents trading activity on that day. The light blue represents the buying and the yellow represents selling, the blue line is the S&P 500 value.

Provided by Kevin Jaegers, Chief Investment Officer of The Retirement Planning Group.

Past results are not a guarantee of future performance.