Your Interests First

A fiduciary is an individual who is ethically bound to act in another person’s best interest. This obligation eliminates conflict of interest concerns and makes the advisor place the client’s best interest above their own.

Fiduciary Standard

Many advisors out there are not fiduciaries or worse – part of the time they are and part of the time they are not.

If your advisor is paid commissions, he or she is likely not a fiduciary. If your advisor is working at a large brokerage firm (Morgan Stanley or Merrill Lynch, for example), at times they might be acting as a fiduciary, but in the same meeting they can take off the “fiduciary hat” without you knowing it and make recommendations that are in their best interest, not yours.

The Importance of Honesty and Transparency —

An Example: Franklin Templeton Income Fund

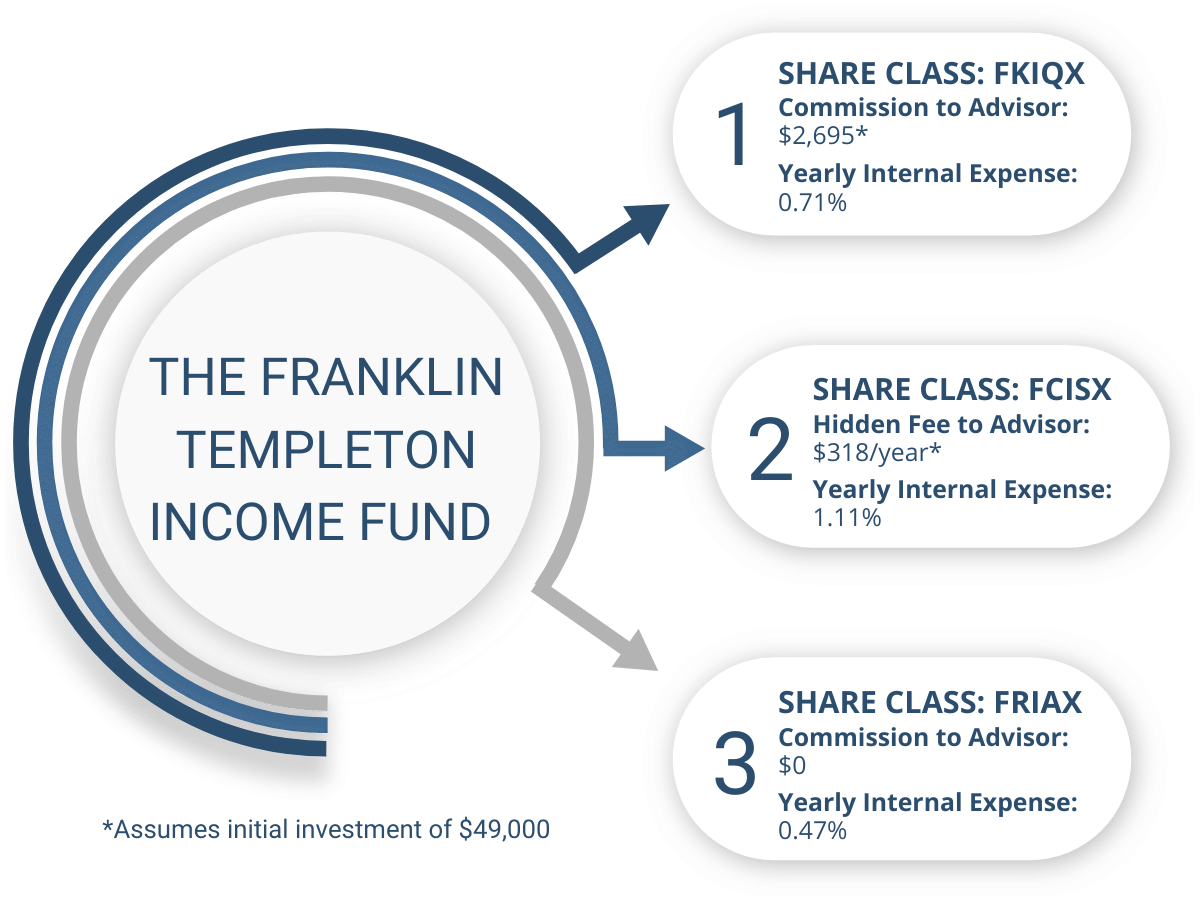

This is a mutual fund that is focused on income and growth. There are several different ways for an investor to own this fund – in fact, we’ve illustrated three different share classes. Note that each share class has its own hidden internal expense and they all vary.

Source

Share Class #1 pays a commission to the advisor.

Share Class #2 pays a yearly hidden fee to the advisor.

Share Class #3 doesn’t have a commission.

Generally, investors want to assume their advisor is looking out for them — which is a reasonable expectation. But thousands upon thousands of investors own Share Classes #1 and #2 – both of which cost investors more from higher hidden internal expenses.

A Wealth Management firm with a fiduciary responsibility would be committed to recommending Share Class #3 – as it is a less expensive option and in your best interest.

If you aren’t working with a full-time Fiduciary, it’s time to make the switch.

Why You Need A Fiduciary

Simply put – for peace of mind.

Wouldn’t it be nice to know that your advisor is always acting in your best interest? At The Retirement Planning Group our entire team takes on a full-time fiduciary role. There are no investment commissions, no backdoor soft-dollar investment arrangements – just honest, transparent advice.

If you aren’t working with a full-time Fiduciary, it’s time to make the switch.