Do you remember the first time you saw a truck with seats bolted into the bed? Did you think those were installed for extra seating? We sure did. But cramming a few more people in the vehicle had nothing to do with it. It all started with chicken. Yes, chicken.

Back in the early 1960s, American chicken farmers had cracked the code on cheap, industrial-scale production. Before long, planeloads of inexpensive U.S. chickens were landing in Europe—particularly in West Germany and France. Local farmers were furious. Their markets were getting flooded, prices were tanking, and their roosters were getting jealous.

In protest, France and West Germany slapped stiff tariffs on imported American chicken. And that didn’t sit well in Washington.

So in 1964, President Lyndon B. Johnson fired back with tariffs of his own. He hit several European exports—potato starch, dextrin, brandy… and light trucks. A full 25% tariff. Just to be clear: American retaliation for a chicken war now included pickup trucks.

Over time, most of those tariffs quietly disappeared. All but one. The 25% duty on light trucks? Still here. Still biting.

And it’s left a weird legacy. Automakers from overseas have spent decades finding creative ways around it. Case in point: the Subaru BRAT pictured above. By installing those seats, Subaru argued the BRAT was a passenger vehicle, not a truck, and was thus subject to a much lower import tariff (2.5% instead of 25%). It worked.

Tariffs have been around for centuries. They’re meant to protect domestic industries by making foreign goods more expensive. However, once a tariff is enacted on a specific product(s) from a country, it’s not uncommon for the affected country to retaliate with a tariff of their own against the country that initiated the tariff against them. This is often referred to as a Trade War.

But companies, especially the savvy ones, don’t just sit back and accept the extra cost. Instead, they often find creative ways to get around tariffs—some legal, some a little questionable, and some downright brilliant.

For investors, these stories are more than history lessons. They reveal the kind of thinking that separates winners from losers in the global economy. Here are five more companies from the last 100 years that turned tariff challenges into strategic advantages.

2. Ford (1920s) – Building Cars Where They Sell

Back in the 1920s, Ford was exploding in popularity, globally. The problem? Many countries slapped heavy tariffs on imported American cars. So Ford did something clever: instead of shipping fully-built cars, they shipped parts.

Ford would send “knock-down kits”—basically a disassembled car in a box—to countries like Canada, the UK, and Australia. Local plants would then assemble the vehicles on-site. Because the cars weren’t technically “imports,” Ford avoided the steep tariffs.

Why it mattered for investors: Ford’s strategy helped it expand globally without getting eaten alive by tariffs. It became a household name around the world and set the stage for international operations that automakers still use today.

Investor takeaway: Companies that think ahead and invest in local operations often gain a lasting advantage—even when global politics shift.

3. IKEA (1980s) – Flat-Packing Around Duties

IKEA is famous for its flat-packed furniture and minimalist Scandinavian design. But few people realize that flat-packing wasn’t just about saving space—it was also about avoiding tariffs.

In the 1980s, European tariffs on imported furniture were often based on the product’s size or weight. Fully assembled furniture attracted higher duties. So IKEA’s design team focused on products that could be disassembled, flat-packed, and easily shipped.

The company also leaned heavily on its network of suppliers in Eastern Europe and Asia, setting up production in lower-cost countries while keeping quality high.

Why it mattered for investors: IKEA’s approach made it a global powerhouse and helped it keep costs low, even as competitors struggled with trade barriers.

Investor takeaway: Product design isn’t just about looks—it can be a powerful tool to optimize logistics and reduce exposure to tariffs and other costs.

4. Apple (2000s–Present) – Global Supply Chain Mastery

Apple’s supply chain is the stuff of legend—and part of that legend includes clever navigation of global trade rules.

During the U.S.-China trade war in the late 2010s, many U.S. companies were slapped with tariffs on goods made in China. Apple, whose products are assembled in China, could’ve taken a big hit. But it managed to avoid much of the pain.

How? Apple leaned into its global structure. For example, some of the most valuable parts—like the iPhone’s chips and design—were developed in the U.S., Ireland, and other countries. Only the final assembly happened in China. In some tariff cases, this meant the majority of the phone’s value wasn’t technically “made in China,” helping Apple minimize exposure.

Later, Apple also started shifting assembly of some products to India and Vietnam—spreading out its risk.

Why it mattered for investors: Apple’s ability to stay ahead of trade policy protected its profit margins and helped maintain investor confidence during uncertain times.

Investor takeaway: Supply chain flexibility is a major competitive edge—especially for global companies.

5. Harley-Davidson (1980s & 2010s) – Playing the Political Game

Harley-Davidson is an iconic American brand, but it has had a bumpy ride with tariffs.

In the 1980s, the U.S. government imposed tariffs on imported Japanese motorcycles to help Harley, which was struggling at the time. But fast forward to 2018, and Harley found itself on the other side of the issue.

After the U.S. imposed tariffs on European steel and aluminum, the EU retaliated with tariffs on American goods—including Harley-Davidson motorcycles. To avoid a 31% tariff on bikes sold in Europe, Harley announced plans to shift some production overseas.

This sparked political backlash, but from a business standpoint, it was a logical move. Harley didn’t want to lose market share in Europe or pass huge price hikes to customers.

Why it mattered for investors: Harley’s swift response protected its international sales and showed the company was willing to make tough calls for long-term health.

Investor takeaway: When politics and business collide, the companies that adapt fast tend to come out on top.

Tariffs are like speed bumps on the road to global trade. They slow things down, create costs, and force companies to pivot. But the best companies don’t just hit the brakes—they find a way around.

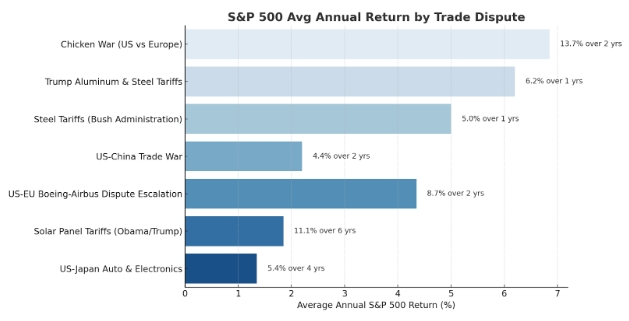

We aren’t minimizing the effect that tariffs can have because many companies don’t have the resources to get as creative as the companies listed above. But, as usual, we like to add context. So, let’s take a look at the historical performance of the S&P 500 (representing the 500 largest companies in the US) during some of the tariff disputes we’ve seen in the last 100 years:

(Resource: Yahoo Finance)

This represents 7 major tariff disputes, the S&P 500 rate of return and duration of time each dispute lasted. Your takeaway should be that none of them ended in Armageddon. Yes, it caused disruption, angst, and uncertainty. But keep in mind, over the various tariff disputes listed above, 500 CEOs of the S&P 500 got out of bed every morning looking for ways to increase and protect shareholder value. Today, they are doing the same thing.

Nearly every market downturn feels unique—and it is in some ways. But it’s never so different that it derails the long-term growth of America’s strongest companies. Great businesses adapt, even through government dysfunction. Let the market react how it will—no one can control that. What matters is that companies are steadily pushing forward, navigating uncertainty, and building long-term value.

Being an investor is hard. But having a plan makes it easier. We strive to make sure every client at TRPG has a plan. Those plans have been back-tested for these sorts of events among many others (Wars, Civil Rights riots, Presidential assassinations and impeachments, inflationary environments, terrorist attacks, dot-com bubble, recessions…etc).

If you are uneasy about today’s events, please reach out to your Wealth Manager and they will be more than happy to update your plan and make adjustments when, where and if necessary!

Stay the course!

![[Blog] 5 Clever Ways Companies Got Around Tariffs(600x400 px) - The Retirement Planning Group [Blog] 5 Clever Ways Companies Got Around Tariffs(600x400 px) - The Retirement Planning Group](https://www.planningretirements.com/wp-content/uploads/2025/04/5-Clever-Ways-Companies-Got-Around-Tariffs_600x400.png)