![[Blog Post] - Do you want a quarter inch drill bit or a quarter inch hole? | The Retirement Planning Group [Blog Post] - Do you want a quarter inch drill bit or a quarter inch hole? | The Retirement Planning Group](https://www.planningretirements.com/wp-content/uploads/2018/03/pexels-photo-834892.jpeg)

Let me paint a picture.

You’ve managed to amass some money in a 401k, there might be a spattering of savings in a few different checking or savings accounts, a random mutual fund exists out there “somewhere” and you know you’ve left a few old 401ks behind at previous jobs. Toss in some life insurance that an old “college buddy” got you into (that, truth be told, you might not even know exactly what it is) and you have 2.5 kids while you’re starring down the barrel of college someday. Intuitively, you know you need to save more, you want to save more, but you just don’t know where to start. More importantly, you don’t even know if all of this “stuff” is working together as it should.

Oh, and soccer practice starts in 15 minutes and you still have to get the kids fed.

Is this you? Have you ever thought, “We really need to get on top of this.” Or, “If I go online, I’m sure I could find the tools to fix this myself.” We have families just like you walk through our doors every day. All of them are perfectly capable and extremely intelligent…but all of them have come to one conclusion: they might have the tools, but they don’t have the time. They don’t need a drill bit, they need a result.

Today we are fighting the epidemic of time erosion. Whether it’s greater demands at work, cellphones that never stop beeping, or kids’ activities, these demands take up a huge chunk of our time. We have time-starved families who walk through our doors every day. They are perfectly capable and extremely intelligent, but all of them have come to one conclusion: they might have the tools, but they don’t have the time. Well, it’s time to find the time.

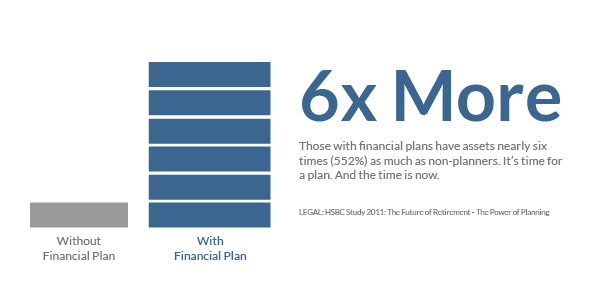

According to an HSBC Finance study, those with financial plans have six times the assets as those without a plan.

Here at TRPG, we know firsthand that you don’t want to start the planning process at age 70.

If you’re ready to design or update your plan, we encourage you to get help from a firm that’s a fiduciary (at a minimum). Getting a plan established really isn’t that hard. It starts with a five-second commitment to set up an appointment. We can tell you that when you start to take control of your finances, the other areas of your life will improve as well.

So, you worry about soccer practices and dinners and let one of our Certified Financial Planners make sure your financial affairs are expertly handled.