![[Blog Post] - Planning for Change in the Market | The Retirement Planning Group [Blog Post] - Planning for Change in the Market | The Retirement Planning Group](https://www.planningretirements.com/wp-content/uploads/2019/04/Fotolia_106039890_S.jpg)

After what seemed like the longest winter ever, spring has finally arrived here in the Midwest. Temperatures are pleasant, the days are longer, grass is green again and baseball games are in full swing. It wasn’t long ago that it felt like winter would never end, but that feeling is quickly becoming a distant memory.

It also wasn’t long ago that the stock market was in the midst of its’ own winter

2018 finished with one of the worst quarters in history, with U.S. stocks down 13.5% during that three-month timeframe. Investors became nervous about the Federal Reserve lifting interest rates too far, too fast, the government was heading towards the longest shutdown in history, trade disputes with China continued and concerns grew over the outlook for the economy and company earnings. Fearful headlines became more common and many investors made poor decisions in a moment of panic. But just as winter conditions have given way to spring, investors’ fear has shifted to more optimism in recent months.

In the first quarter of 2019, U.S. stocks had their best start since 1998 and bonds logged their best start since 1991, as interest rates fell to start the year (bond prices and rates move in opposite directions). Given fears of a global growth slowdown, the Federal Reserve has seemingly changed course on their approach to interest rates, adopting a wait-and-see approach before resuming any rate increases. We’ve also seen resolution to the government shutdown and progress on a U.S.-China trade deal. As of the time of this writing, stocks are once again approaching the record levels they hit back in the fall of last year.

But much like the changing seasons, markets will inevitably go through periods of weakness again sometime in the future.

These are great times for investors to consider their strategies and approach to dealing with market uncertainty and the ups and downs investments often take in the short term. At The Retirement Planning Group, we continue to believe that diversification is a great tool for managing the unpredictable nature of investing.

In addition to investing in many different segments of the market, both in the U.S. and overseas, we also invest in many companies within each of those types

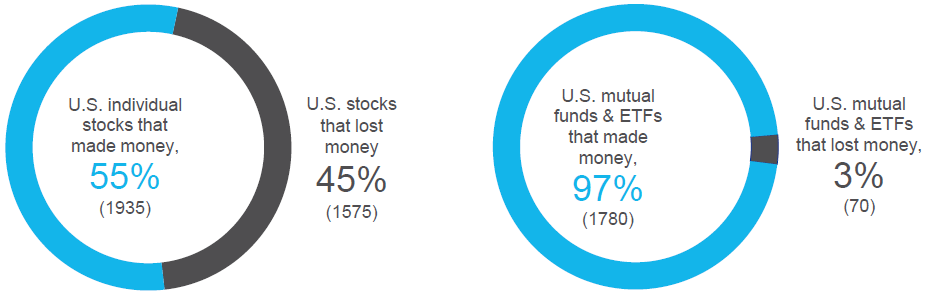

It’s an effective strategy for reducing risk compared to more concentrated portfolios, while also allowing you to participate in gains wherever and whenever they occur. The illustration below shows the degree to which this diversified strategy can help protect on the downside. Over the last five years, a shocking 45% of U.S. individual stocks have lost money, vs. just 3% of mutual funds and ETFs that have done so. Source: BlackRock Student of the Market, March 2019. Time period from 12/31/2013 – 12/31/2018.

Source: BlackRock Student of the Market, March 2019. Time period from 12/31/2013 – 12/31/2018.

Above all, the recent downturn and quick recovery that followed should reinforce the idea that those who panic during market declines may permanently diminish their chances for long-term success. The market gives us enough evidence that these ups and downs will continue going forward, so it’s best to have a plan ahead of time for managing those moments vs. just reacting to the situation when it comes. This is why we place an emphasis on building and maintaining a financial plan for those nearing or in retirement. Markets don’t move in straight lines, so we plan for an uncertain world that will often transition to another season when you least expect it.

Although we strive to understand market trends and drivers of performance over short periods of time, we continue to maintain a long-term focus with your investments to give you the best odds of meeting your long-term goals. If you have any questions, we encourage you to reach out to your advisor.

Kevin Jaegers, CFA