Quick Takes

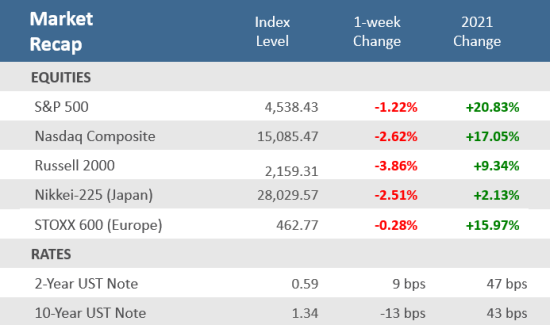

- Stocks declined sharply for the second straight week as the Omicron variant spread quickly around the world, and to a dozen U.S. states, and Fed Chair Jerome Powell hinted at accelerating its tapering of bond purchases.

- November’s employment report showed slower-than-expected job creation last month. Nonfarm payrolls increased by just 210,000 for the month, well below the 573,000 jobs predicted by economists polled by Dow Jones. However, the unemployment rate fell sharply to 4.2%, better than estimates of 4.5%.

- Other economic news was constructive, November services sector growth hit a new record high, factory orders came in well above expectations, and weekly unemployment claims continue to be lower than expected.

Markets jolted by Omicron and accelerated tapering

The volatility that began late Thanksgiving week continued through the last few days of November and into December. The two biggest culprits for the market gyrations were the new Omicron variant headlines on the Friday after Thanksgiving and a renewed bout of selling on Tuesday following Federal Reserve Chairman Jerome Powell’s surprising announcement that the Fed may accelerate tapering (i.e., a quicker-than-expected rollback of its bond-buying program) and that it was time to retire the “transitory” reference with regards to inflation. In the end, the S&P 500 fell for the second week, losing -1.2%, but the damage was worse for the technology-heavy Nasdaq which dropped -2.6% and the small cap Russell 2000 Index, down -3.9% – its fourth straight weekly decline, its worst stretch since mid-July. Fears of the new Omicron variant hit investors as it spread to more than 38 countries around the world, from just 23 only 2 days earlier. Early data suggest that it is spreading more efficiently than previous variants but appears to be milder with lower hospitalizations than other variants and has yet to have any attributed fatalities. Fed Chair Powell also cited Omicron as a potential threat to the US economy, but it was his comments on accelerating the pace of the Fed’s bond purchase program that surprised investors. Previously Powell was indicating that next summer would be the end the asset purchases, but if that timeline is accelerated the market may need to price in more interest rate hikes in 2022. Friday’s November employment report didn’t help buoy markets either as it was a mixed bag, with much lower-than-expected jobs gains, but a much better-than-expected improvement in the unemployment rate and labor force participation rate, which both hit their best levels since the pandemic. All the uncertainty led to a surge in volatility with the CBOE VIX volatility index rising to 35 during Friday’s trading, which was the highest it’s been since January. It settled down by the end of the session and finished the week at 30.67, which is also the highest weekly close since January.

Chart of the Week

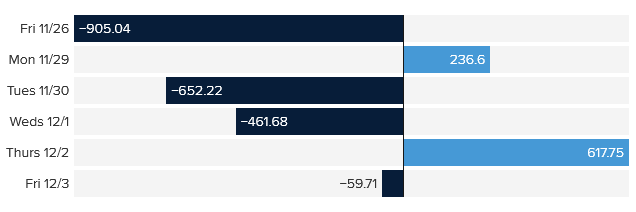

The Dow Jones Industrial Average swung hundreds of points during the day over the last several sessions. Likewise, the S&P 500 and Nasdaq have seen volatility levels spike with several straight days of 1% or greater moves up or down. News of the new Omicron COVID variant sunk stocks on the shortened day after Thanksgiving, sending the Dow down 905 points, its worst day since October 2020. Then Fed Chairman Powell jolted markets on Tuesday 11/30 with the unexpected message that the Federal Reserve is expected to speed up the tapering of its bong purchases (i.e., reduce the pace of monthly bond buying).

Omicron and Powell Stir Up Market Volatility

Daily point change in the Dow Jones Industrial Average

Source: FactSet, CNBC.

Economic Review

- The November Employment Report was a bit of a conundrum with a disappointing headline Nonfarm Payrolls gain of just 210,000 jobs (seasonally adjusted) added to the U.S. economy when expectations were for 550,000 and September had 546,000. However, Unemployment Rate improved to 4.2% from October’s 4.6% rate, and easily beat expectations for 4.5%. The labor force participation rate rose too, hitting 61.8% versus October’s 61.6%, and above expectations of 61.7%. That marked the highest level since March 2020. Professional and business services, as well as transportation and warehousing, led gains while hiring in leisure and hospitality was sluggish, and retail lost jobs despite the traditional holiday hiring season.

- Despite rising mortgage rates, Pending Home Sales rebounded sharply in October, jumping +7.5% from September, well above forecasts of +1.0 but down -4.7% from the prior year. The average rate on the popular 30-year fixed mortgage was just below 3% in mid-September, but climbed to 3.22% by the end of October, according to Mortgage News Daily. Sales were strongest in the Midwest and South regions.

- November’s Dallas Fed Manufacturing Index slowed unexpectedly but remained in expansion territory (a reading above zero), dipping to 11.8 from 14.6 in October and well below forecasts of 15.0.

- The Conference Board’s Consumer Confidence Index fell to 109.5 in November from 111.6 in October (downwardly revised) which was below expectations for 110.9. Both the Present Situation Index portion of the survey and the Expectations Index of business conditions for the next six months declined.

- The S&P CoreLogic Case-Shiller National Home Price Index, which measures average home prices in major metropolitan areas across the nation, rose +19.5% for the year ended September, down from a +19.8% annual rate the prior month. The 20-city composite S&P CoreLogic Case-Shiller Home Price Index rose +19.05% year-over-year in September, slightly below estimates. Compared to the prior month, home prices were up 0.96%, below expectations of 1.20%. The separate FHFA Home Price Index was up +17.7% over last September, and +0.9% above August levels.

- The November Institute for Supply Management (ISM) Manufacturing PMI (Purchase Managers Index) showed that the manufacturing expansion (a reading above 50) accelerated. The index rose to 61.1 from October’s unrevised 60.8 level, slightly below estimates of 61.2. New orders, production, and employment all accelerated, while inventories fell but remained in expansion territory and supplier delivery times shrunk but remained elevated. Inflation pressure remained, but were down -3.3 points to 82.4, falling from the 92.1 mark in June that was the highest reading since July 1979. The ISM Services Index made another record high of 69.1, up from 66.7 in October – the previous record, and beating expectations for 65. The business activity component accelerated while the prices paid component dipped (but remains elevated).

- The final November Markit U.S. Manufacturing PMI Index was unexpectedly revised lower to 58.3 from the preliminary 59.1 level, where it was forecasted to remain, and was just below the 58.4 level in October. The final Markit U.S. Services PMI Index was revised higher to 58 from the prior estimate of 57. Markit’s report is independent and differs from the ISM report as it polls a larger range of companies size-wise and it weights its components differently.

- Factory Orders rose +1.0% in October beating September’s upwardly revised +0.5% increase. Durable Goods Orders—preliminarily reported last week—were revised up to a -0.4% decrease for October, and excluding transportation, orders were unadjusted at a +0.5% advance.

- October Construction spending rose +0.2%, below forecasts of +0.4% but above September’s upwardly revised -0.1% decline.

- The Fed’s Beige Book, a subjective assessment of business activity across all Fed districts, indicated that most Districts reported that the economy grew at a modest to moderate pace, with consumer spending increasing slightly, but low inventories held back sales of some items, notably light vehicles. Activity in the leisure and hospitality segment picked up in most Districts as the spread of the Delta variant retreated in many areas. Construction activity generally increased but was restrained by scarce materials and labor. Likewise, manufacturing growth was solid, but materials and labor shortages limited expansion.

- Weekly unemployment claims were 222,000, below estimates of 240,000 but up from the surprisingly low downwardly revised 194,000 in the prior week. Continuing claims fell by 107,000 to 1,956,000, which is a new pandemic low.

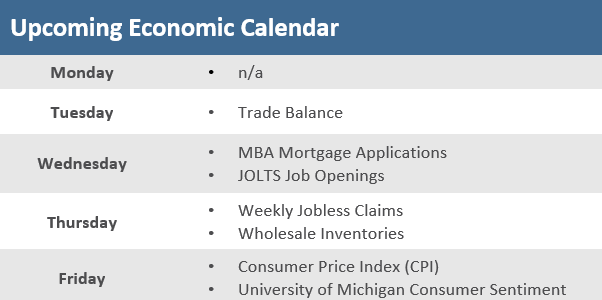

The Week Ahead

The upcoming economic calendar is as bare as it has been in several weeks. Most eyes will be focused on Friday’s read on consumer inflation. Any material strength in the Consumer Price Index (CPI) could add fuel to the Fed’s recent posturing for a faster taper. Bloomberg Economics expects November’s CPI to be the fastest annual rate of inflation since the 1980s. If that’s what Friday’s CPI report shows it could mean a Fed announcement confirming a faster taper could come as soon as the following week at the December 15 FOMC meeting. Of course, the wild card continues to be the ongoing developments with the Omicron variant. Any economic slowdown or additional supply-chain bottlenecks could complicate the Fed’s considerations.

Did You Know?

CONTINUITY AT THE FED — President Joe Biden nominated Jerome Powell on Monday 11/22/21 for a 2nd term as chair of the Federal Reserve. Powell, on the job since 2/05/18, has overseen the nation’s central bank during the pandemic, coordinating a series of stimulus programs that kept money flowing throughout our economy. During his nearly 4-years as Fed chair, the S&P 500 has gone from 2649 to 4595, an annualized total return of +16.4% (source: BTN Research).

RISING DEMAND — The USA had a housing shortage of 3.8 million homes as of 12/31/20, i.e., 3.8 million homes are needed to meet the national demand for single-family homes (source: Freddie Mac, BTN Research).

A WORLD RECORD — Diane Friedman ran 100 meters in 71 seconds on 8/15/21 at the Michigan Senior Olympics, the fastest 100 meters ever run by a woman at least age 100 (source: GrowingBolder.com, BTN Research).

This Week in History

This week in 1941, Theodore Benna, the future creator of the 401(k) retirement plan, was born in Manns Choice, Pennsylvania (source: The Wall Street Journal).

Asset Class Performance

The Importance of Diversification. Diversification mitigates the risk of relying on any single investment and offers a host of long-term benefits, such as lowering portfolio volatility, improving risk-adjusted returns, and helping investments to compound more effectively.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent the performance of specific mutual funds and/or exchange-traded funds recommended by The Retirement Planning Group. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Chris Bouffard is CIO of The Retirement Planning Group (TRPG), a Registered Investment Adviser. He has oversight of investments for the advisory services offered through TRPG.

Disclaimer: Information provided is for educational purposes only and does not constitute investment, legal or tax advice. All examples are hypothetical and for illustrative purposes only. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed. Please contact TRPG for more complete information based on your personal circumstances and to obtain personal individual investment advice.