Quick Takes

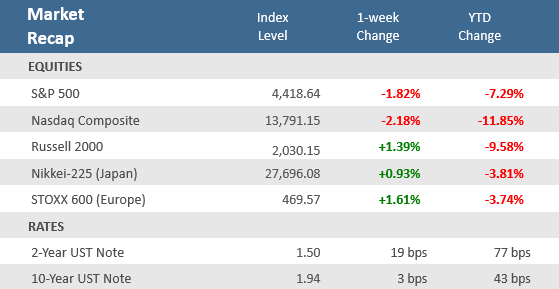

- Stocks continue their choppy trading, getting whipsawed in the past week by a hotter-than-expected consumer inflation report, surprisingly hawkish comments from St. Louis Fed President James Bullard, and National Security Advisor Jake Sullivan’s proclamation that there was a “distinct possibility” that Russia could invade Ukraine.

- The hot inflation data and Bullard comments sent bond yields soaring, with the benchmark U.S. 10-year Treasury yield closing above 2.0% for the first time since 2019. But a “flight to quality” on the Russia-Ukraine warnings Friday afternoon took yields down as safe Treasuries were bid up.

- The bulk of S&P 500 companies have now reported earnings for Q4-2021 and 77% have beat Wall Street estimates and are on pace for earnings growth of about 27%. And so far companies have been able to maintain profit margins in the face of inflationary pressures with J.P. Morgan calculating S&P 500 profit margins holding at 13.2% in Q4 versus the high of 13.6% recorded in Q2-2021.

Fed Speak and Russia-Ukraine Tensions Erase Weekly Gains

The choppy back-and-forth trading that has characterized most of 2022 continued into last week. However, for the first half of the week stocks were, on balance, drifting higher. At the close Wednesday, the S&P 500 was up nearly +2% for the week. And even after dipping on a hotter-than-expected consumer inflation report on Thursday morning (see the Chart of the Week for more details), stocks regained their footing and cruised back to the highs of the week and looked like they were headed for a third straight week of gains. But then late Thursday morning Federal Reserve Bank of St. Louis President (and FOMC voter) James Bullard told Bloomberg news that he supports the Fed hiking rates by 100 basis points (1%) by July, including a 50-basis point hike in March. Despite brushing off the hot inflation data earlier, the market quickly rolled over following these extremely hawkish comments. Treasury yields spiked by the end of Thursday with the yield on the 2-year note surging 24 basis point to 1.58% (a rare 7 standard deviation move), while the 10-year Treasury yield rose 10 basis points to 2.03% ¬– the first time since 2019 it was above 2%. By the end of day, the S&P 500 had fallen -1.8%, back to where it started the week, and the tech-heavy Nasdaq Composite index was down -2.1%. Stocks tried to stabilize early Friday, even with disappointing consumer sentiment data being released early in the morning, but then markets were delivered another blow for the second consecutive day after National Security Advisor Jake Sullivan acknowledged there was a “distinct possibility” that Russia could invade Ukraine before the end of the Olympics. Stocks moved sharply lower in the final hours of trading and Treasury yields, after spiking the day before on the Bullard comments, gave back a good portion of Thursday’s advance as investors bid up ‘safe havens’. At the end of Friday, the S&P 500 had slid another 1.9% to end the week down -1.8%. The Nasdaq plunged -2.8% of Friday, taking it down to -2.2% for the week. The small cap Russell 2000 Index was outperformer, losing -1.0% Friday to remain positive +1.4% for the week. The 2-year Treasury yield finished at 1.5% while the 10-year closed the week at 1.9%. Schwab’s Chief Global Investment Strategist Jeffrey Kleintop points out that markets have historically shrugged off geopolitical events involving Russia and that Russia makes up a very small portion of the main global and emerging market indexes, while Ukraine has no exposure in such indexes. In the short-term though, an already skittish market will likely be susceptible to headline risks coming from the Russia-Ukraine turmoil. Domestically, it is important to keep an eye on fundamentals, and on that front, with earnings for Q4-2021 winding down, and 359 of the S&P 500 Index companies reported, 68.7% have topped revenue estimates and 76.8% have bested earnings expectations. Compared to last year, revenue growth is on pace to be up nearly +16.4% and earnings expansion is on track for about +26.9%. And so far companies are growing those earnings while largely maintaining profit margins, despite the inflationary pressures in wage and input costs. According to data from J.P. Morgan, S& P 500 companies are tracking to have profit margins of 13.2% for Q4, which is not far off from the record 13.6% recorded in Q2-2021.

Chart of the Week

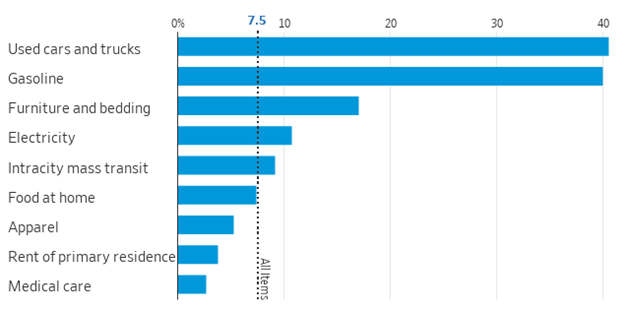

January consumer inflation was surprisingly strong, accelerating at a 40-year high of 7.5% annually. Strong consumer demand and pandemic-related supply constraints continued to push up prices in January as the January Consumer Price Index (CPI) rose +0.6% month-over-month, beating expectations for a +0.4% increase, and matching December’s upwardly revised gain. Core CPI, which excludes food and energy, also came in at a +0.6% rate, ahead of expectations for a +0.5% gain, also matching December’s (unadjusted) increase. Compared to last January, prices jumped +7.5% higher, which was the fastest since 1982 and above forecasts for +7.3% and December’s +7.0% rise. Core CPI up +6.0% from last year, also a 40-year high—and above forecasts for a +5.9% increase and December’s unrevised +5.5% rise. As shown in the Chart of the Week below, prices were up sharply for a number of everyday household items, including used vehicles, fuel, furniture and electricity. A sharp uptick in housing rental prices—one of the biggest monthly costs for households—contributed to January’s increase.

U.S. Inflation Rate Accelerates to a 40-Year High of 7.5%

Consumer prices, change from one year earlier

Source: Labor Department, The Wall Street Journal.

Economic Review

- The December National Federation of Independent Business (NFIB) Small Business Optimism Index fell to 97.1 from 98.9 in December, below the estimate for a decline to 97.5. Small business owners remain concerned about inflation, worker shortages, and future economic conditions. The NFIB said, “More small business owners started the new year raising prices in an attempt to pass on higher inventory, supplies, and labor costs. Owners are also raising compensation at record high rates to attract qualified employees to their open positions.”

- The MBA Mortgage Application Index fell -8.1% last week, after rising +12.0% the prior week. The decline came as a -7.3% decline for the Refinance Index was met with a -9.6% decrease for the Purchase Index, as the average 30-year mortgage rate went up +5 basis points (0.05%) to 3.83%.

- December Wholesale Inventories grew +2.2% month-over-month, upwardly revised from previous report of +2.1%, where expectations expected it to remain. Sales were up +0.2%, far under forecasts of +1.5% and November’s upwardly revised +1.7% rise.

- The February preliminary University of Michigan Consumer Sentiment Index fell much more than expected, dropping to 61.7 from January’s 67.2, versus expectations for a dip to 67.0. The index hit the lowest level since October 2011 with both the current conditions and expectations components of the survey falling to the weakest levels in more than a decade, with the latter continuing to outpace the former by a wide a margin. The 1-year inflation forecast rose to 5.0%—the highest since 2008—from 4.9%.

- Weekly unemployment claims fell for the third week in a row, down -16,000 from the prior week’s upwardly revised level of 239,000 to 223,000, below expectations for 230,000. Continuing claims were unchanged at 1,621,000, below estimates of 1,615,000.

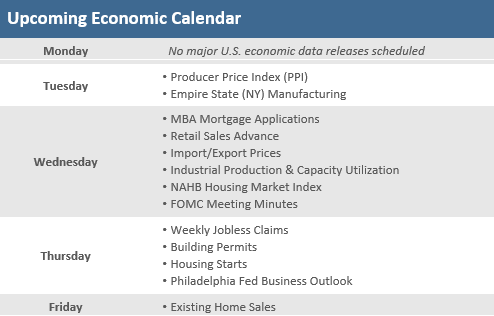

The Week Ahead

Investors aren’t likely to get a reprieve from choppy markets in the upcoming week. Markets were headed for a positive week last week until St. Louis Fed President James Bullard amplified hawkish comments on Thursday, and then Friday afternoon brought reports that Russia appears to be on the verge of invading neighboring Ukraine. Those headlines triggered stocks to sell off and overwhelm the week’s gains. This week brings more inflation data with Producer Prices on Tuesday, as well as Import Prices and the release of minutes from the Fed’s last meeting on Wednesday. St. Louis Fed President James Bullard, who’s hawkish comments sunk the market last Thursday, will be on CNBC’s “Squawk Box” Monday. Retail Sales will be reported Wednesday and Leading Economic Indicators on Friday. A full slate of housing data is also coming with the NAHB Home Index, Building Permits, Housing Starts and Existing Home Sales. Q4-2021 earnings season is winding down but there are still some major reports, including Cisco, Deere, Nvidia, Marriot and Walmart.

Did You Know?

CONSECUTIVE YEARS? — The taxable bond market was down -3.5% YTD (total return) as of 2/11/2022. This is following a -1.5% loss (total return) in 2021. In the last 46 years, the taxable bond market was down just 4 years and never down in back-to-back years (source: BTN Research, Bloomberg).

PROFIT TAKING — The average U.S. diversified stock fund declined -6.7% in January 2022, coming off a pandemic-defying +22.5% rally for all of 2021. International-stock funds declined -4.4%, after having rallied +9.6% in 2021 (source: Refinitiv Lipper, The Wall Street Journal).

DEUCES ARE WILD — On Wednesday 2/02/2022 in a pro basketball game against the New York Knicks, Memphis Grizzlies NBA player Desmond Bane (jersey # 22), shot 4 of 18 from the field (22.22% shooting percentage), had 2 assists, 2 turnovers, 2 steals and 2 blocked shots. Bane is in his 2nd NBA season. He made the All-Rookie Second Team following his first year in the league (source: Adam Price Research, BTN Research).

This Week in History

SAVE A HORSE, RIDE A TRACTOR – On February 7, in 1804, John Deere was born in Rutland, VT. In 1837, he threw the American frontier wide open by inventing the world’s first self-cleaning steel plow, making it possible for pioneers to work the rich, vast farmlands of the midwestern and western United States. He also penned the quote “Strike while the iron is hot.” (Source: The Wall Street Journal).

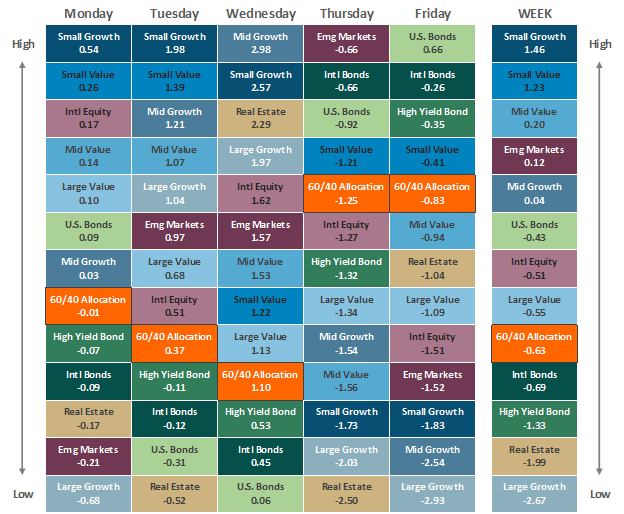

Asset Class Performance

The Importance of Diversification. Diversification mitigates the risk of relying on any single investment and offers a host of long-term benefits, such as lowering portfolio volatility, improving risk-adjusted returns, and helping investments to compound more effectively.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent the performance of specific mutual funds and/or exchange-traded funds recommended by The Retirement Planning Group. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Chris Bouffard is CIO of The Retirement Planning Group (TRPG), a Registered Investment Adviser. He has oversight of investments for the advisory services offered through TRPG.

Disclaimer: Information provided is for educational purposes only and does not constitute investment, legal or tax advice. All examples are hypothetical and for illustrative purposes only. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed. Please contact TRPG for more complete information based on your personal circumstances and to obtain personal individual investment advice.