Working with an Edelman Financial Engines Advisor?

There are some things you definitely should know.

6 things you should know if you are working with an Edelman Financial Engines Advisor:

Out-of-Control Expenses

At Edelman Financial Engines (EFE), your starting fee can be a jaw-dropping 1.75%/year (on the first $400,000). Plus the internal expense of the investments they use (example: .50%/year). Add it all up and your total fee could be 2.25%/year!!! Unfortunately, Wall Street greed has come to roost in Any Town, USA.

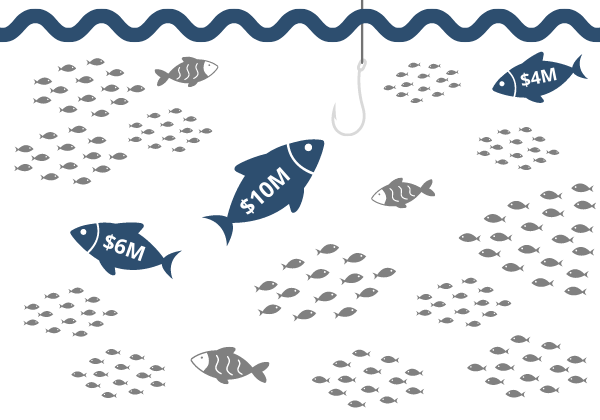

Small Fish - Big Pond

Your advisor may have over 500+ clients to keep tabs on. You can do the math – there are 2000 working hours a year – if your advisor has 500 clients, your entire financial welfare hinges on the hope that you are getting 4 hours of your advisor’s time. Unless you have 10s of millions of dollars, you are a small fish.

Spinning Plates

Your EFE Advisor is typically under supported. Each office has just a few assistants. Even the busiest senior advisors with more than $500 million in client assets may have to share an assistant. So instead of focusing on your really important financial issues – your advisor is likely overwhelmed with client servicing issues and quotas to hit.

Watered-Down Planning

They use an internal financial planning tool but the capabilities are limited. It might look like you are getting a Ferrari, but under the hood is a gerbil and a wheel.

Revolving Door

First, it was the Mutual Fund Store, then Financial Engines, now Edelman. What’s next? Private equity has flipped this company over and over. Meanwhile, investors get pulled in different directions with a lack of consistency, stability, or knowing who will buy the company next.

Tax Help?

Your EFE advisor might talk about tax strategies regarding investments, but that’s where it will likely end. At this point, they’ve yet to offer to all of their clients dedicated CPAs that will file your Federal and State taxes.

How do we know all of this?

Several people that work at The Retirement Planning Group used to work at The Mutual Fund Store/Financial Engines/Edelman. Edelman Financial Engines is closer to a marketing firm that incidentally happens to sell investments. That doesn’t feel right to us. And it likely doesn’t feel right to you.

See what they have to say about working at The Retirement Planning Group

Chris Bouffard, CFA

Chief Investment Officer"At The Retirement Planning Group, our mission is to help people create the financial well-being and confidence they need to live their best life while striving to be the easiest firm to work with on the planet. It's an exciting culture to be a part of!"

Troy Hedman, CMFC®, CRPC®

M&A Succession Planning Manager & Senior Wealth Manager"I joined The Retirement Planning Group because of their consistent growth and unwavering commitment to doing the right things for their clients. Their vision to “be the easiest firm to work with on planet Earth", aligns with my goal to provide the best experience, services, and technology to my clients, enabling them to achieve financial well-being and confidence. The combination of the Tax Team and Wealth Managers working together under one roof is a game-changer for clients. The team camaraderie and strong family atmosphere were the icing on the cake, and I couldn’t be more excited about the future."

John Vu, CFP®, CRPC®

Senior Wealth Manager"One aspect that appeals to me about The Retirement Planning Group is that members of the leadership team are wealth managers who serve clients, which means they have a deep understanding of their clients' needs. As a result, TRPG operates as a client-focused firm, in contrast to many registered investment advisory firms that are owned by large private equity firms whose primary objective is to maximize profits."

Are You Ready to Take Control of Your Financial Future?

We take our fiduciary responsibility seriously. Our firm has over 20 years of experience in guiding families and individuals toward achieving their financial goals.

Complete the form below to connect with one of our wealth managers, who can provide honest answers to all of your questions.

By submitting this form you consent to receive emails, phone calls, and text messaging communication(s) from The Retirement Planning Group at the email and number above. Your consent is not a condition of any purchase or obligation. Message and data rates may apply. Message frequency may vary. You are also acknowledging our Privacy Notice and Privacy Policy.

We take our client relationships seriously.

But you don’t have to take our word for it.

Disclosure: Google reviews are voluntary. Anyone who provides a statement does not receive compensation in any form from The Retirement Planning Group. We appreciate feedback from our clients and strive to be the easiest firm to work with on planet Earth.