Five Simple Reasons Your Advisor Wishes You Weren’t Here Right Now

Your current advisor is worried that you might leave him or her if you knew all we did for our clients.

Here are a few ways we outshine your current advisor:

We don't just manage money and do planning work, we also do your taxes for you. For FREE*.

Lots of Wealth Management firms say that they do “tax planning”. We don’t just talk about tax strategies regarding your investments, we see those strategies executed all the way to the end by filing your return with the IRS.

People that reach out to us typically have one advisor spinning 20 plates in the air.

Your advisor is likely serving over 500** households.

At TRPG, you’ll be one of roughly 200 households per team – which equals more time, oversight, and attention for you!

Other advisors may still be using a rolodex to keep track of clients.

We’ve got incredible engagement platforms like our phone app with client vault and in-app messaging and direct text messaging with your team!!!

No hidden fees!

Total transparency.

Once you know just how much better of a solution you could possibly have – for probably the same cost or less – isn’t it worth your time to dig a little deeper?

Let us show you how we can improve your situation!

Many of our current clients out-grew their old advisors. Clients generally come to us from:

Our client experience is second to none – we are focused on being the easiest firm to work with on planet Earth.

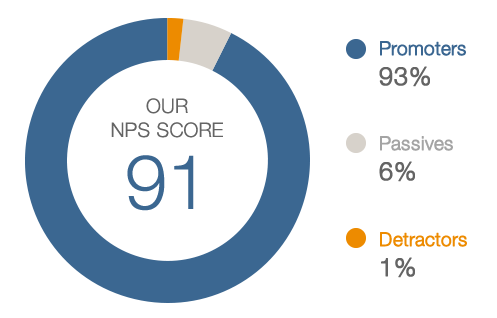

Clients give us a higher recommendation score than companies like Apple®.

Net Promoter Score is the percentage of clients rating their likelihood to recommend a company, a product, or a service, to a friend or colleague. The average score in the Financial Services sector is 34. Our average score is 91 (from 3/1/2020 to 3/1/2021). The Retirement Planning Group does not control client responses. Twice a year clients are provided the opportunity to share the likelihood they’d refer a client to us by providing a score between 1 and 10 (10 being the most likely to refer). “Promoters” are the percentage of clients that selected a score of 9 or 10. “Passives” are the percentage of clients that selected a score of 7 or 8. “Detractors” are the percentage of clients that selected a score of 1 to 6.

*Assumes we are managing accounts totaling more than $500,000

**Average is 521: https://www.barrons.com/articles/americas-top-1-200-financial-advisors-1457157598