Repairing Your Investment Portfolio Amid COVID-19

In these uncertain times, we know investment performance can weigh heavily on your heart and your future. That’s why we created this 3-minute video about how rebalancing your investment portfolio can help repair some of the damage from the COVID-19 pandemic.

Video Transcription:

Hey, Kansas City, my name’s Kevin Conard.

I’m one of the owners of The Retirement Planning Group.

We’re a wealth management firm and we’ve been helping out our clients a lot over these last couple of weeks with the coronavirus.

And well quite honestly I just wanted to make sure that other investors out there were doing the right things with their portfolio to help them set it up for success here in the future.

Hopefully, you find this video of some value and we’ll get right into it.

Okay, so here’s how this works.

If you’ve been an investor for any time, especially over the last six to eight weeks, we’ve seen a lot of volatility in the market and likely when you started out investing your money, you found an even dollar amount or a certain percentage that you wanted to put in say three funds, and we’ll use this as an example right here.

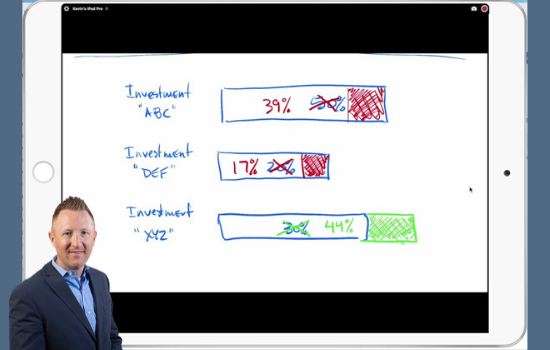

Let’s say you invested 50% of your money in one fund, 20% in this fund here, and 30% in this final fund.

What I can tell you is if those are the targeted weights that you’re trying to keep your portfolio at, 50, 20, and 30, over the last six weeks, it’s extraordinarily unlikely it’s still at those targeted ranges.

And what you’ll likely see if you were to open up your account statements is that some of your positions more than likely will have gone down in value.

The remainder of which might have gone up in value and this presents a real opportunity.

You’ll see these two funds here were originally targeted to have 50% in one and 20% in the other, but since they’ve gone down in value, they make up a smaller percentage of the portfolio.

Your final position here hypothetically has gone up in value and what you can do here and something that you should go look at taking care of is what we call rebalancing.

In other words, we will sell off this portion of the portfolio to get back to this targeted 30% and redeploy these dollars into these two particular investments.

Now, the beauty of that is this investment here has managed to go up in value because we’ve had a diversified portfolio while the other two positions in the portfolio have gone down in value.

And when we sell positions here at a gain and reinvest them into these two positions here, you’re in essence selling high, buying low, and you’re getting these positions down here at a steep discount.

And what happens is, is when things start to rebound, if you’ve added more money into these two positions while they were down, the overall total value of your portfolio will go up faster and you’ll have more money to show for it when it’s all said and done.

So again, this is something we’ve been doing for our investors. If you’re not working with an advisor, this is something you would really want to take a strong look at doing with your own portfolio.

*This video was originally recorded on April 23, 2020.