Retirement may seem far away when you are in your 20s. You are probably just starting out in your career, learning about budgeting, paying rent or a mortgage, starting a family, or living life on your own for the first time.

Regardless of your situation, if you take some time to learn the foundation of good retirement planning, are able to start saving, your future self will thank you. Here is more about how to plan for retirement in your 20s.

What should I know?

Planning for retirement in the simplest sense means saving now so you have enough to retire comfortably in the future. As you grow older and your financial picture takes hold, there are other considerations you will want to plan for: such as estate planning, medical care, taxes, and more. However, in your 20s, your focus should be on learning the basic ways of saving for retirement, how it works, and starting to save something now.

Creating an investment account is one popular way of saving for retirement, as this money compounds over time. This compound interest is your best friend and best way to make money, as you age. You have probably heard many people saying they wished they had saved earlier, compound interest is why.

Here is a scenario:

If you start at age 25 and invest $100 a month until age 65 (40 years) assuming an average return of 7%, you would have $241,000 1.If you get started 10 years later at age 35, you would have less than half that amount, only $114,000. While neither amount is enough to retire, it demonstrates the importance of starting early.

You may be asking “how do I plan for retirement in my 20s? Where do I start? What investment accounts make sense?”

1 – Investor.gov

Where do I invest? A 401k, 403b, a taxed account? IRA or Roth IRA?

If you have a full-time job with benefits, you might have access to a retirement account where you can invest some of your money. You may also have access to a pension, which is another form of saving for retirement.

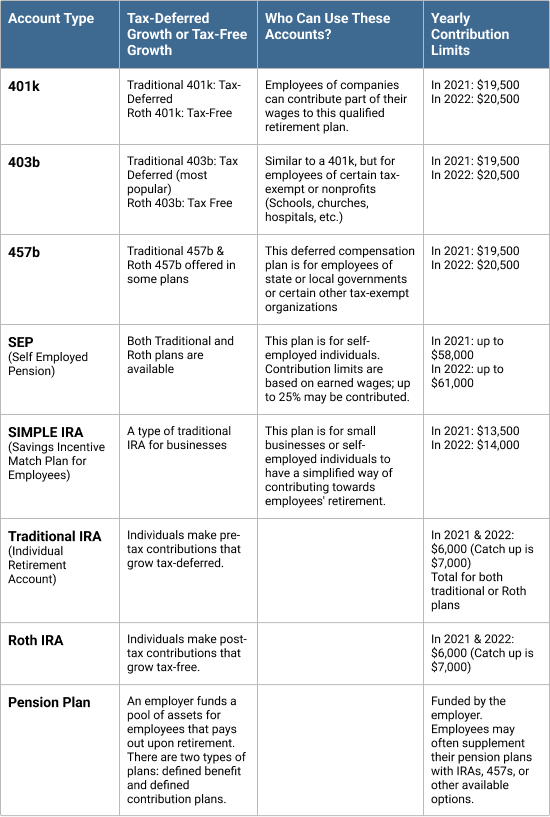

Here are some of the most popular forms of investing and saving for retirement and some terminology definitions.

| Account Type | Tax-Deferred Growth or Tax-Free Growth | Who Can Use These Accounts? | Yearly Contribution Limits |

| 401k | Traditional 401k: Tax-Deferred Roth 401k: Tax-Free |

Employees of companies can contribute part of their wages to this qualified retirement plan. | In 2021: $19,500 In 2022: $20,500 |

| 403b | Traditional 403b: Tax Deferred (most popular) Roth 403b: Tax Free |

Similar to a 401k, but for employees of certain tax-exempt or nonprofits (Schools, churches, hospitals, etc.) | In 2021: $19,500 In 2022: $20,500 |

| 457b | Traditional 457b & Roth 457b offered in some plans | This deferred compensation plan is for employees of state or local governments or certain other tax-exempt organizations | In 2021: $19,500 In 2022: $20,500 |

| SEP (Self Employed Pension) |

Both Traditional and Roth plans are available | This plan is for self-employed individuals. Contribution limits are based on earned wages; up to 25% may be contributed. | In 2021: up to $58,000 In 2022: up to $61,000 |

| SIMPLE IRA (Savings Incentive Match Plan for Employees) |

A type of traditional IRA for businesses | This plan is for small businesses or self-employed individuals to have a simplified way of contributing towards employees’ retirement. | In 2021: $13,500 In 2022: $14,000 |

| Traditional IRA (Individual Retirement Account) |

Individuals make pre-tax contributions that grow tax-deferred. | In 2021 & 2022: $6,000 (Catch up is $7,000) Total for both traditional or Roth plans |

|

| Roth IRA | Individuals make post-tax contributions that grow tax-free. | In 2021 & 2022: $6,000 (Catch up is $7,000) | |

| Pension Plan | An employer funds a pool of assets for employees that pays out upon retirement. There are two types of plans: defined benefit and defined contribution plans. |

Funded by the employer. Employees may often supplement their pension plans with IRAs, 457s, or other available options. |

Source: IRS.gov

What is tax-deferred growth vs tax-free growth? If you invest in a traditional account, this means you are investing pre-tax dollars that will grow over time. For example, when you get your paycheck, they take out your 401k investment money before your taxes are calculated. This money grows until you take it out at retirement, and the whole amount is taxed as you take it out. This is tax-deferred growth, you are deferring taxes until retirement.

With tax-free growth, you are putting the money you have already paid taxes on in a Roth account. When you take this money out later, none of it is taxed.

Contribution Limits: If you only have one type of retirement plan, your contribution limits are fairly straightforward. If you are contributing to more than one plan, be careful. Things can get tricky. It is best to consult with a professional advisor who can help you navigate some of the details of these plans and contribution limits so you aren’t stuck with a hefty tax bill or fine. As you plan for retirement in your 20s, knowing your contribution limits is important.

How much do I contribute now for retirement?

The general rule of thumb is 10% of your income. This is only a general rule, and every situation is different. It greatly depends on your goals and objectives for the long term.

Entrepreneurs starting a business in their 20s may invest their money in their business and minimize their retirement savings now, expecting the business to supply a nest egg for the future. Someone in a retail job may take advantage of overtime hours to invest their maximum limits, while expenses are low and the option to earn extra money is plentiful.

A retirement planning professional will help discuss your personal situation, future goals, and work with you to craft a strategy and investment amount to get you where you want to be.

How to plan for retirement in my 20s – getting started

Getting started with retirement planning in your 20s will set you up for long-term success. The first step is learning a little about the different retirement plan options, and the next step is creating a plan. This plan should outline your goals for the future: do you want to own a home? Do you plan to travel? Do you have potentially significant expenses due to medical issues or other liabilities? Are you looking to get married or already married?

Retirement planning can be overwhelming, which is why many people turn to Chartered Retirement Planning Counselors℠ (CRPC®) and other financial planning professionals for help. These professionals will walk you through different scenarios and needs you may not have considered.

You may opt to start this plan on your own. However, if planning is overwhelming, the simplest way is to invest in your employee-sponsored plan (401k, 403b, etc.) if one is available to you. If you do not have one available, you may want to consult with a professional to see what retirement options you can invest in and which options are best for your situation. IRAs are popular choices, but there are income limits for these plans. The most important thing about planning in your 20s is getting started, so compound interest works in your favor.

At The Retirement Planning Group, our team is comprised of retirement planning professionals and wealth managers, tax experts, investment managers, and more. Once we identify your goals and needs, we will help create a long-term retirement planning strategy for you.

Ready to get started? You’re asking the right questions: ” How to plan for retirement in my 20s”. Next step, fill out the form below to speak with one of our wealth managers. No games, no gimmicks, no sales presentations. Just a call to see if there is a fit for working together on your retirement dreams.