Tax Loss Selling: How To Keep The IRS Out Of Your Pockets

Kevin Conard, CRPC®, shares how you can keep the IRS out of your pockets and save money with Tax Loss Selling in this quick video.

Video Transcription:

Hey, my name is Kevin Conard. If you’re over age 55, an investor, and have lost some money in the market over the last couple of months, and are interested in keeping more money in your pocket and less money in the IRS’s pocket, then I think you’ll probably find what I have to show you pretty interesting.

All right, so let’s jump right into this. I want to show you a strategy that will help keep the IRS out of your pockets. And if you stick around to the end of the video, I have a special offer that you can download. Now, this strategy is for investments that are outside of retirement accounts.

So it doesn’t work inside of an IRA, and it does not work inside of a 401k. And with the recent market volatility, a lot of Americans find themselves in a position where maybe they made an investment.

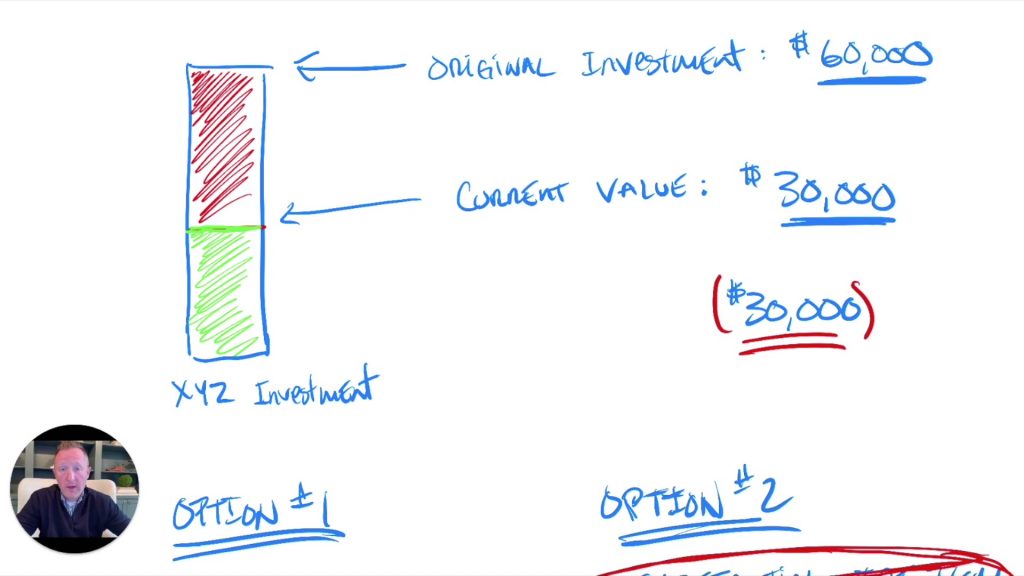

In this example, we’ll assume $60,000. And with the volatility, the value has dropped to 30, and therefore there’s a $30,000 loss at this point.

(0:00:50)

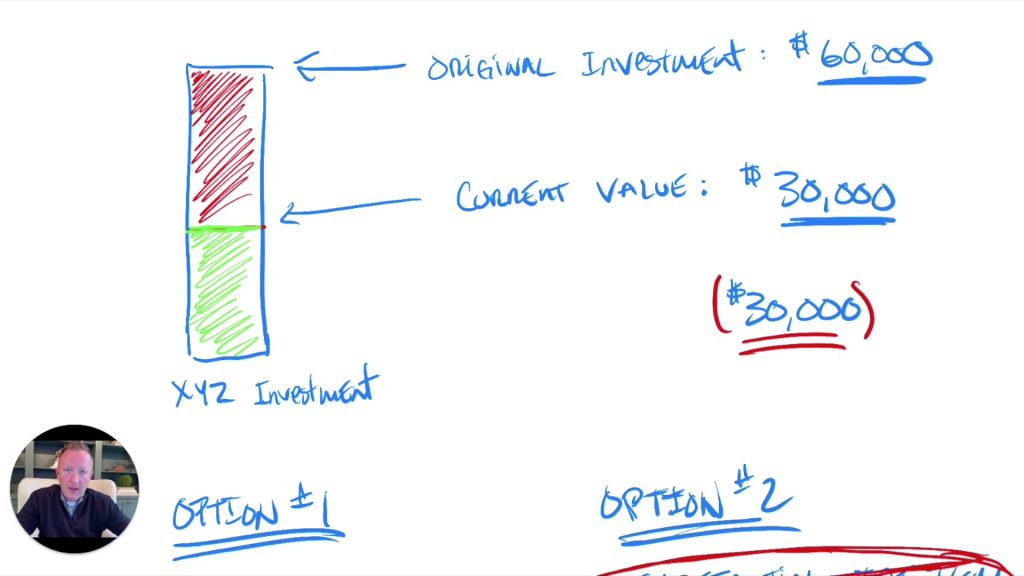

Now this loss can be very helpful for you come tax time, but there’s a couple of things you have to do. And one of those is you would have to sell it to physically take the loss on it.

Now, when you sell it, the IRS has a couple of rules here. They say, you cannot sell something and then two minutes later re-buy the exact same position and claim it as a loss.

They say, you have to be out of that position for 30 days. And so that leaves you a couple options here.

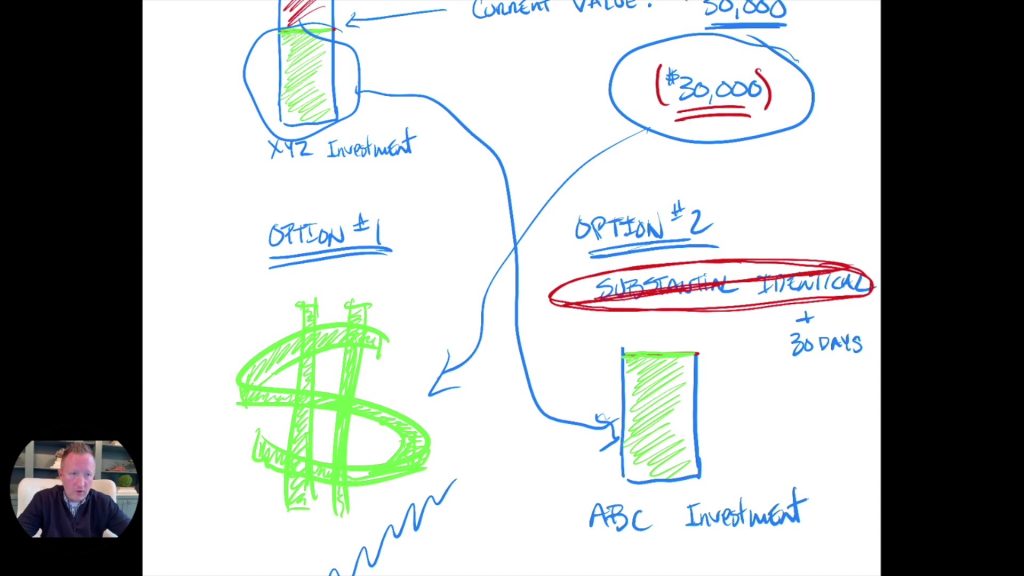

Option number one is you sell it and you put it all into cash. Well, the problem with doing that is if the value of the market goes up while you’re sitting in cash, then you lose out on the recovery of that investment.

The other option is you can take this $30,000 and reinvest it into something else that’s pretty similar, but it can’t be identical.

(0:01:38)

And then you do that, if the market starts to recover well, then you’ll be there to participate in it.

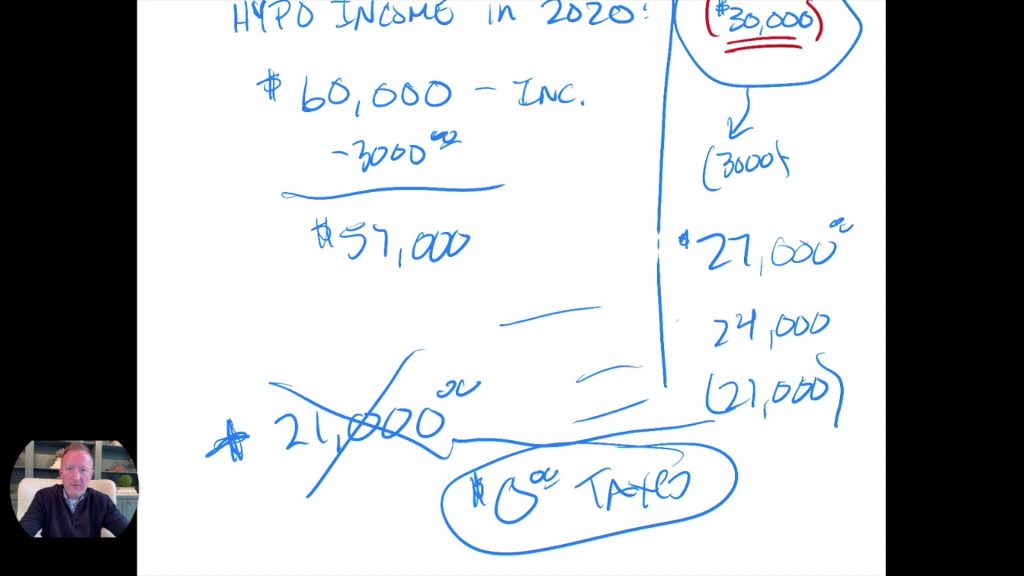

And in the meantime, you’ve locked in that $30,000 loss. Now let me show you how this comes in to help you come tax time. If you hypothetically made $60,000 in 2020, you would have this $30,000 in your back pocket and you get to carry this thing around with you for the rest of your life.

And where you could use it in this next year, is the IRS will allow you to use $3,000 of the loss to offset your income in a given year. So now you only have to report income as if you made $57,000.

And since you use $3,000 up at the loss, you now are carrying forward into future years, that $27,000 loss.

And you can keep doing this year after year after year, and taking that $3,000 against your ordinary income.

But let’s say you get out here in a few years and you have a big gain on one of your investments. And let’s say the gain was coincidentally $21,000 a total gain on that investment, maybe the original investment you went back into.

Since you’re carrying this loss around, you will be able to use this loss in that year to offset that gain and therefore, owe zero in taxes.

(0:03:04)

And this is one of the benefits of doing what is known as tax loss selling (or tax loss harvesting).

So hopefully you’ve found this helpful and as promised, here is that special offer if you click on the link below.

Disclaimer: Information provided is for educational purposes only and does not constitute investment, legal or tax advice. All examples are hypothetical and for illustrative purposes only.

*This video was originally recorded on May 27, 2020.