Quick Takes

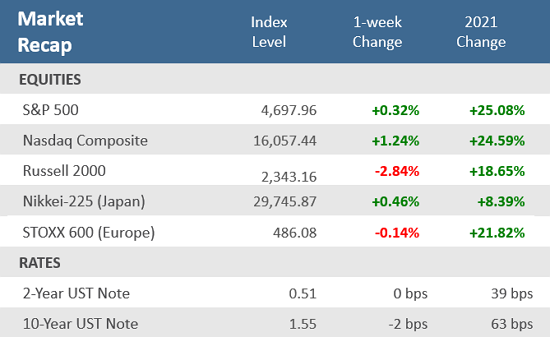

- Global stocks advanced over the week but closed slightly below their all-time highs. Positive earnings momentum continued to bolster stocks as well as a strong October retail sales report. The strength was primarily in large-cap growth stocks while small-caps and value trailed. U.S. bonds eked out a small gain as treasury yields saw a slight decline.

- For the first time in weeks, concerns over a resurgence of Covid-19 weighed on markets late in the week after Germany mandated new restrictions for unvaccinated people on Thursday, and then on Friday Austria announced it would re-enter a full national lockdown due to a spike in cases.

- President Biden signed a $1 trillion infrastructure bill that funds over a five-year period and puts $550 billion into transportation, broadband, and utilities, as well as $110 billion into roads, bridges, and other major projects. The House of Representatives voted Friday to pass President Biden’s $1.7 trillion social safety net bill, sending it to the Senate for passage.

Europe sparks new Covid fears, but stocks were able to advance

Strong earnings from some big retailers and strong U.S. retail data helped markets overcome more inflation pressures and some renewed fears about Covid yet. The S&P 500 was up +0.3% for the week, while the technology-heavy Nasdaq gained +1.2%. However, small caps struggled with the Russell 2000 Index dropping -2.8%. It wasn’t a very busy week on the economic front, but October retail sales, October industrial production, and November regional manufacturing activity came in better than expected. Earnings also continue to help sustain the markets. About 95% of S&P 500 companies have reported earnings for the third quarter, and 82% of them are beating Wall Street’s expectations, according to Bloomberg. S&P 500 companies are on track to grow earnings by about +41% over last year.

For the first time in weeks, concerns over a resurgence of Covid-19 weighed on markets following several primarily European-based developments late in the week. On Thursday, Germany mandated new restrictions for unvaccinated people after its fourth wave of cases hit a record high. Then on Friday, Austria announced it would re-enter a three-week national lockdown due to a spike in cases. Turning to Washington DC, President Biden signed a $1 trillion infrastructure bill that funds over five years. The package will put $550 billion in new funds into transportation, broadband, and utilities, as well as $110 billion into roads, bridges, and other significant projects. The House of Representatives voted Friday to pass President Biden’s $1.7 trillion social safety net bill, sending it to the Senate, which is likely to face an uphill battle in the coming weeks.

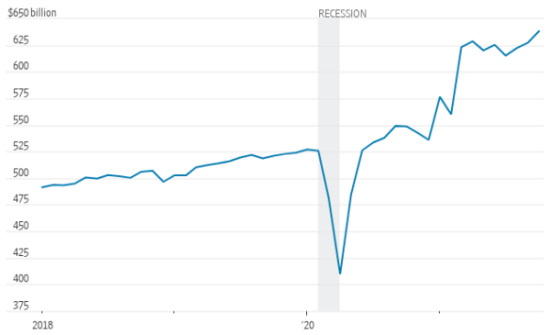

Chart of the Week

With only about a month to go until Christmas, U.S. shoppers powered a burst of buying. In the October advanced estimate, sales at U.S. retail stores, online sellers, and restaurants rose +1.7% (seasonally adjusted) month-over-month. The was ahead of the Bloomberg consensus estimate of +1.4% and above from the upwardly revised +0.8% in September. Ex-autos and gas sales rose +1.4%, also better than expectations of +0.7% and September’s downwardly revised +0.5% gain. Consumers boosted spending despite inflation and lingering Covid-19 concerns. The elevated consumer spending suggests healthy holiday sales this season. After the Commerce Department released the retail sales report, J.P. Morgan raised its forecast for fourth-quarter U.S. gross domestic product (GDP) growth to +5% from +4%.

Hot October Retail Sales

Total U.S. retail and foodservice sales

Source: US. Census Bureau via St Louis Fed, The Wall Street Journal. Note: Seasonally adjusted.

Economic Review

- Housing Starts fell -0.7% in October, to an annual pace of 1,520,000 units, below the Bloomberg consensus forecast of 1,579,000 units and below September’s negatively revised pace of 1,530,000 units. However, Building Permits, one of the leading indicators tracked by the Conference Board, rose +4.0% at an annual rate of 1,650,000 units, beating expectations for 1,630,000 units and the downwardly revised 1,586,000 unit pace in September. Homebuilders have been hampered by rising costs, material shortages, and trouble attracting workers.

- The October National Association of Home Builders (NAHB) Housing Market Index showed homebuilder sentiment unexpectedly rose to 83 from 80 in September, which was also the forecast for October. It was the third consecutive month the NAHB index advanced.

- The Federal Reserve’s reported that Industrial Production was up +1.6 in October, versus estimates of a +0.9% increase and September’s unrevised -0.7% decline. Capacity Utilization rose to 76.4%, versus expectations for a moderate rise to 75.9% from 75.2% in September.

- October Import Prices rose +1.2% over September, beating the estimates for a +1.0% gain, and well above September’s unrevised 0.4% increase. Compared to a year ago, prices were up by +10.7%, also beating forecasts for a +10.3% increase and September’s upwardly revised +9.3% gain.

- The Conference Board’s Leading Economic Index (LEI) rose +0.9% in October, above estimates of +0.8% and September’s downwardly revised +0.1% gain. It was the eighth-straight month LEIs were positive, primarily due to the net contribution from jobless claims. Building permits and ISM new orders were also positive contributors and helped to overcome negative components such as waning consumer expectations and underwhelming average workweek.

- The Empire Manufacturing Index, a measure of activity in the New York region, showed that the index rose to 30.9 in November from 19.8 in October, well above the Bloomberg estimate of 22.0. Growth in new orders and employment both accelerated, though the expansion in inventories slowed.

- The Philly Fed Manufacturing Business Outlook Index moved further into expansion territory (a reading above zero) in November, rising to 39.0, well above expectations for an increase to 24.0 and 23.8 in October. New orders and shipments saw expansions at faster paces, while delivery times widened, and the average workweek rose. Prices continued to climb, and employment growth slowed.

- The November Kansas City Fed Manufacturing Activity Index declined more than expected but remained comfortably in the expansion zone (a reading above zero). The index fell to 24.0 from 31 in October and below expectations for a decrease to 28.0.

- Weekly unemployment claims were 268,000, down 1,000 from the prior week, but above estimates of 260,000. Continuing claims fell by 129,000 to 2,080,000, which was a new pandemic low.

The Week Ahead

In a Thanksgiving-shortened week, all the economic reports are packed into the first three days. Wednesday is particularly busy with the GDP and PCE releases, but also Consumer Sentiment, New Home Sales, and the Fed’s meeting minutes. Inflation signals will be a big focus throughout the week’s economic reports. Other big news could include President Biden’s choice of Fed chief. Historically stocks tend to do well in Thanksgiving week, setting up for a year-end Santa rally.

Did You Know?

“TAKE-UP” RATE — 68% of American workers in the private sector worked for employers that provided retirement benefits as of 3/31/21. 51% of the 68% who had access to a plan elected to participate in their company’s retirement plan (e.g., 401(k) plan), i.e., 75% of private-sector workers who had an option to participate elected to do so (Source: Bureau of Labor Statistics, BTN Research).

SAVING FOR RETIREMENT — The 401(k) individual pre-tax contribution limit will be $20,500 in 2022, up from $17,000 in 2012 or 10 years earlier. If the same inflation adjustments that have occurred over the last ten years repeat over the next decade, the 401(k) individual pre-tax contribution limit will be $24,721 in 2032 (Source: IRS, Bureau of Economic Analysis, BTN Research).

WHAT HAS CHANGED? — 20,331 homes have been repossessed by lenders nationwide YTD through 10/31/21. That’s down from 50,238 homes repossessed for all of 2020, 143,955 homes in 2019, 230,305 homes in 2018, and 291,579 homes in 2017 (Source: Attom Data Solutions, BTN Research).

This Week in History

This week in 1883, prompted by the American Railway Association, the U.S. divided into four simple time zones for the first time, replacing the old “system” in which each state had dozens of mini-zones where time differed by a few minutes from the next. No longer would it be noon in Chicago, 11:27 a.m. in Omaha, 11:41 a.m. in St. Paul, and 11:50 a.m. in St. Louis (Source: The Wall Street Journal).

Asset Class Performance

The Importance of Diversification. Diversification mitigates the risk of relying on any single investment and offers a host of long-term benefits, such as lowering portfolio volatility, improving risk-adjusted returns, and helping investments to compound more effectively.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent the performance of specific mutual funds and/or exchange-traded funds recommended by The Retirement Planning Group. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Chris Bouffard is CIO of The Retirement Planning Group (TRPG), a Registered Investment Adviser. He has oversight of investments for the advisory services offered through TRPG.

Disclaimer: Information provided is for educational purposes only and does not constitute investment, legal or tax advice. All examples are hypothetical and for illustrative purposes only. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed. Please contact TRPG for more complete information based on your personal circumstances and to obtain personal individual investment advice.